If you are relatively new to the cryptocurrency world, it might be useful to know that Bitcoin Cash (BCH) was created as a hard fork from Bitcoin (BTC).

Now, twice a year, as part of its scheduled protocol upgrades, the BCH network hard forks. Unlike previous BCH hard forks, there was a competing proposal that was not compatible with the published roadmap. On November 15th, both groups started creating blocks in their respective, separate blockchains. Thus, Bitcoin SV (BSV) was created as a result of that split. Here, we share with you what you need to know about BSV.

What is Bitcoin Satoshi Vision?

BSV is a cryptocurrency that sprouted after the just concluded fork on the BCH Network. SV developers lead by controversial billionaire and crypto developer Craig Wright claim Bitcoin SV is built to realize Satoshis Vision. The team claims that it would restore the original features of the Bitcoin protocol on the BSV blockchain.

Technically, it is a new full bode implementation for BCH. However, the SV team clearly stated it does not intend to create a new Bitcoin Variant or Token. Neither are they asking exchanges to list a new BSV or BSV token. Instead, the team revealed that Bitcoin SV gives miners another choice for consensus rules for Bitcoin Cash.

There many other implementations of the Bitcoin Cash Protocol. The Bitcoin SV team believes that their new implementation would compete favorably with the other six implementations of BCH. On the original Bitcoin White Paper, Satoshi revealed that it is up to miners’ voting with the hash power to decide rules for the network.

What is a fork?

Software is made up of lines of code: hundreds, thousands, sometimes even millions of them. Large software projects have many contributors, especially in “open source” projects where the code is publicly available and users can suggest improvements.

If there is no central authority governing how the software should be developed, sometimes disagreements occur, and different groups decide to split off on their own. So, to “fork” a project is the process of duplicating the code as it was at a certain point, then taking it in a new direction.

Though software forks are prevalent in the open source world, the hard/soft fork distinction is usually only found in blockchain technology, and differs slightly from other software forks. Where blockchain is concerned, the fork relates to the contents of the blocks that make up the blockchain.

In a soft fork, some nodes begin to accept blocks that are created according to a new set of rules, but continue to accept blocks produced under the old rules. This means that while there is some difference between the two, they are mutually compatible, and the validity of the blockchain as a whole is accepted by both rule sets.

In a hard fork, the change means that blocks made according to a new set of rules are considered invalid according to the old rules, and vice versa. This leads to a split in the blockchain: from that point, miners (who validate transactions) and users need to decide which set of rules to enforce. Effectively, there are now two versions of the cryptocurrency that cannot be reconciled.

What is Satoshi’s Vision?

During Bitcoins life cycle, we saw the creation of BCH as a result of a Bitcoin hard fork, which in turn has now led to the creation of BSV, a version of the original coin that claims to want to rediscover Satoshi’s original vision and become the worlds most popular and most adopted, fully decentralized cryptocurrency, through a hard fork of BCH.

Satoshi’s whitepaper clearly explains how his coin should work along with its intentions. Despite the fact that the whitepaper is fully available online for everyone to read, there’s a huge debate over Satoshi’s vision.

- “A Peer-to-Peer Electronic Cash System”

Those words might seem straightforward, but right away, we have controversy within the community. When you call something a ‘cash system’ it suggests that it should be used like cash – for everyday purchases, as a store of value, as a unit of exchange, and as a medium of transfer. It’s money.

Others, however, believe that digital gold has never intended to be cash. Despite what Satoshi’s vision claims, many BTC supporters feel bitcoin works best when it has limited utility as cash, but acts purely as a store of value.

- Proof of Work

The whitepaper outlines the proof of work system, discussing how one CPU would equal one vote. As long as the majority of CPUs were acting in the best interest of the network, then the network would stay secure. Those CPUs would be motivated to act in the best interests of the network because they receive a reward for doing so and because it costs money to provide proofs of work to the network. This basic, economic system of costs and rewards is what secures bitcoin.

The true vision of BSV now focuses across four key areas that aim to make it better than Bitcoin Cash and Bitcoin:

- Stability

Bitcoin SV developers claimed that they built their token to be as stable as possible, unlike the other implementations. The developers said businesses and big enterprises require stability before they can adopt a technology platform. However, several changes to the bitcoin protocol still failed to solve this problem.

Ideally, big corporations and businesses do deep background research on a particular technology before using it. This is attributed to the fact that they would spend a huge amount of money on technology. The current status of Bitcoin Cash Network does not attract such investments.

The SV team revealed that their only change would be restoring bitcoin to the original version. The team said Bitcoin SV offers the assured stability that would encourage innovation and institutional adaptation of Bitcoin Cash.

- Scalability

Bitcoin SV developers believe that BCH should be able to process transaction volume at the required scale. The SV team developed a roadmap primarily focused on delivering capacity increase. This could be achieved through bigger default or miner configurable block sizes and performance improvements.

By enabling massive scaling, BSV would allow the BCH blockchain to support significantly higher transaction volumes and more transaction fees for miners. This is important for miners to maintain profitability as the block reward will halve again in the year 2020 (reducing from 12 BCH to 6.25 BCH for each block), and halve again in later years. Massive scaling is also important to convince enterprises to use BCH for their blockchain applications – which will require big blocks and large throughput capacity.

- Security

The team reveals that the BSV project focuses on rigorous quality assurance for mining node software to ensure max security.

It further explains that the high-level security achieves by implementing a rigid set of test phases with full traceability. The SV team boasts that their level of security is only comparable to the aerospace, medical and national security industries.

The project highlighted that its team will use best practice management process. This would include engaging external expertise from other security-sensitive industries to monitor and audit its systems. Furthermore, the project is to engage the services of a leading blockchain security audit firm.

As the final security breach detection mechanism, the project is to offer lucrative bug bounty programs only comparable to Google’s and Microsoft’s. The team believes this will help them assemble security researchers from around the world to their platform.

- Safety

The SV team believes instant transactions are the key to unlocking and benefits of the larger merchant market for bitcoin cash. Bitcoin SV claims to feature security improvements that can bolster the future of Bitcoin cash security. Furthermore, the SV team developed a Roadmap takes safe and instant transaction as a major priority.

The success of the BCH SV will significantly depend on its adaptability both to miners and users. Price fluctuation is the most problematic factor preventing businesses adopting bitcoin.

How to Get BSV?

It’s been a few weeks since the BCH hard fork and the blockchain split that saw the birth of the BSV token. Because of the split and the identical chain histories, anyone who owned BCH prior to the split now owns the same amount of BSV. Some people elect never to bother splitting their coins, while others choose to split their coins and sell one or the other right away – or alternatively to hold them both:

- To claim BSV, if you own your private keys, you’ll need to configure the official BSV wallet.

- If you had it on an exchange or third party wallet, you need to follow their directions.

- With exchanges you’ll do nothing and it is a matter of waiting.

- With third party wallets you must follow the directions on their official website very carefully.

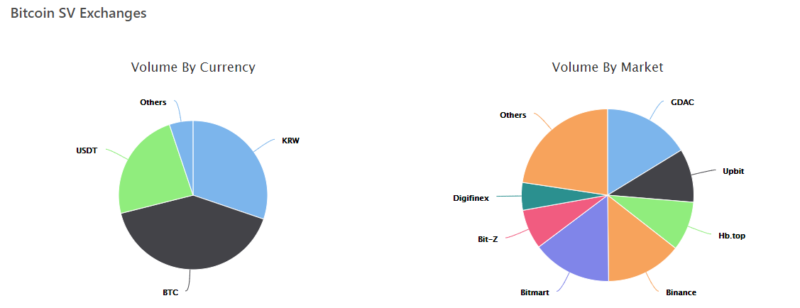

The new token is already on sale on some the crypto exchanges:

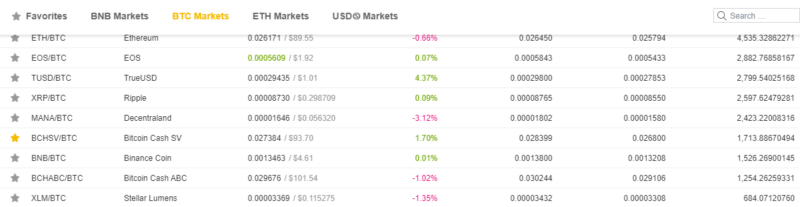

- Binance

Binance is one of the largest cryptocurrency exchanges today that supports multiple coins, has a lot of trading pairs and includes relatively new cryptocurrencies, and BCHSV is among them. Binance is famous for its fast performance, safety, high user experience and multilingual support. The Binance app is available for both Android and iOS.

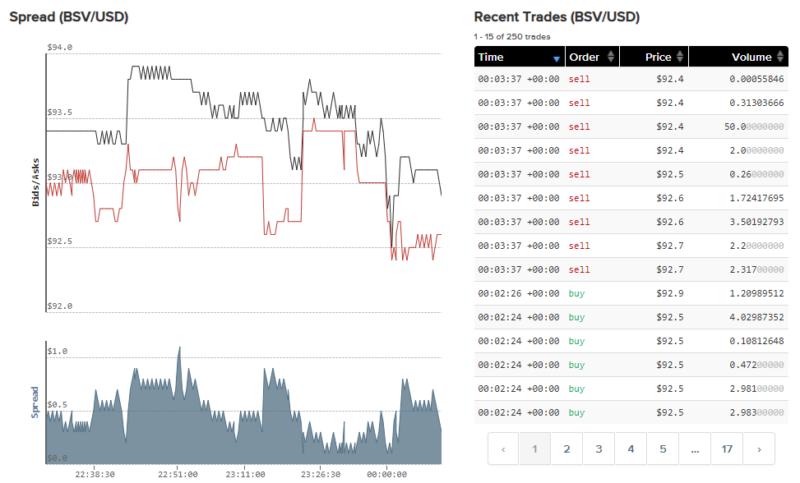

- Kraken

Kraken is rated between 5th and 7th in terms of trading volume. The advantage of this cryptocurrency exchange platform is that it accepts fiat currencies. Fees are included in every transaction and, depending on the amount, they are relatively larger than other exchanges. Also, the system has multiple currency pairs, which is very convenient due to the fact that all common currencies are available. Among them you can find the following pairs as well: BSV/USD, BSV/EUR, BSV/XBT.

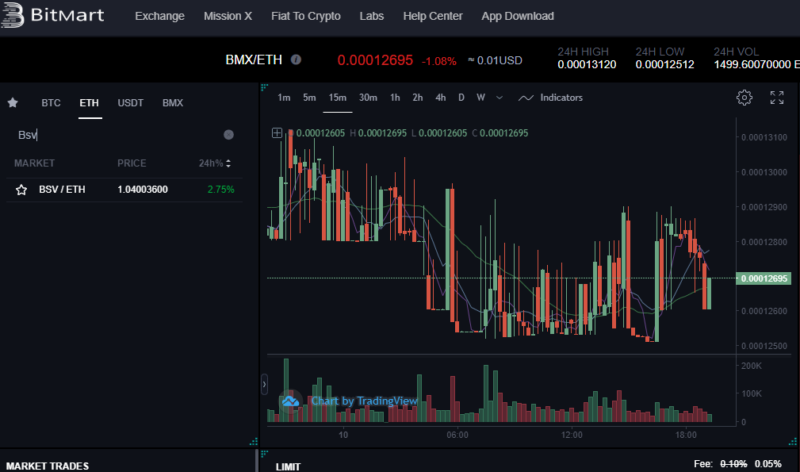

- BitMart

BitMart is a cryptocurrency exchange that offers unique features like decentralized trading, futures contract trading, and spot trading across all major cryptocurrencies. The platform describes itself as “a powerful and reliable cryptocurrency exchange platform.” And this is where you can get a new cryptocurrency BSV.

Bitcoin SV Wallet

Here are a few wallets that may attract your attention:

- Guarda

Guarda is famous as it is a non-custodial, lightweight BSV wallet, which is both web-based and mobile based. It is regarded as one of the best software BSV wallets. Guarda has an easy interface, wherein the users have full control of their private keys. The best part is that Guarda supports many cryptocurrencies apart from BSV, which is why the users can manage multiple cryptocurrencies from the same interface, that too securely.

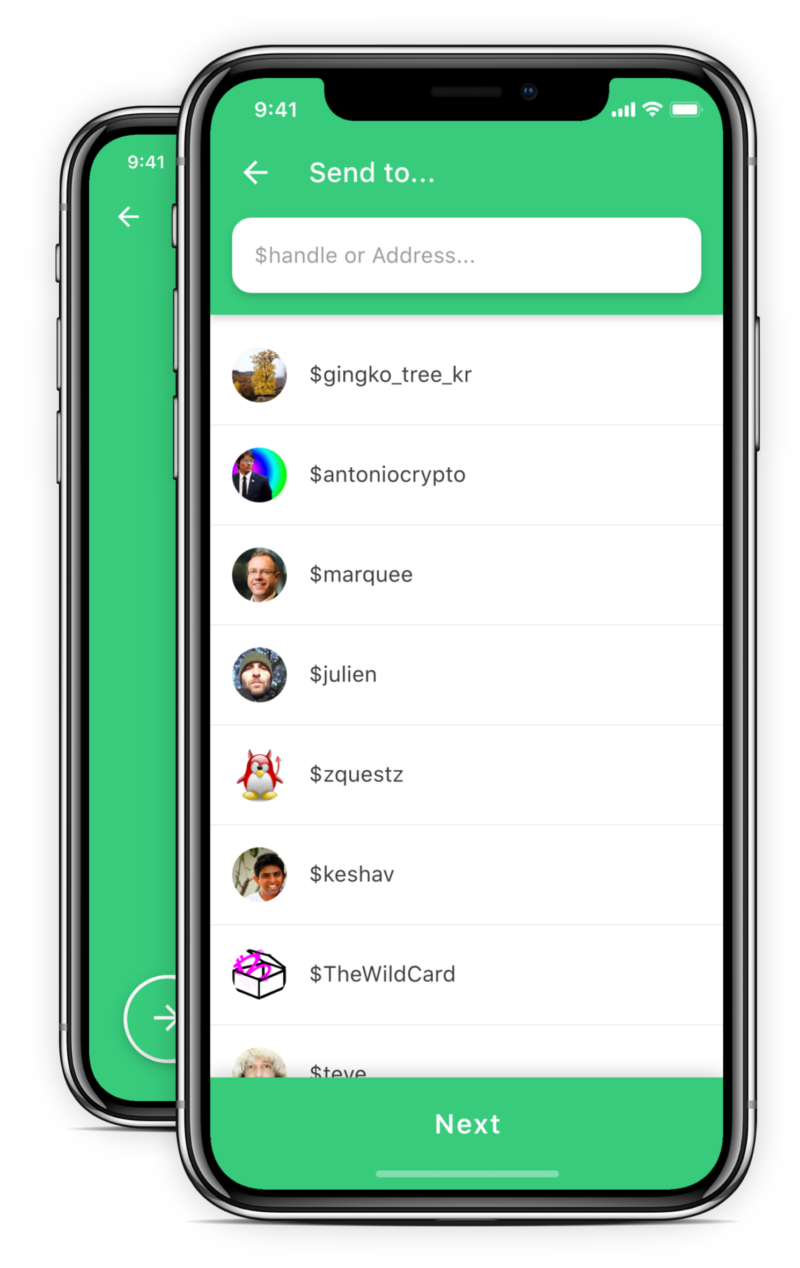

- HandCash

HandCash is one of the easiest ways to store the new token, which works like handing regular cash, wherein you just need your username/handle instead of the regular address. You can back up your account in the Google drive and can recover it in one click. It runs on the main net and is considered as one of the top BSV wallets.

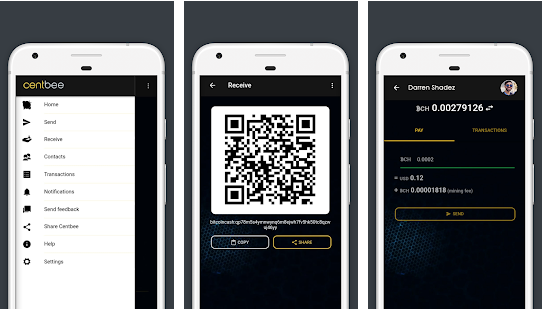

- CentBee

CentBee is the easiest way to store and send Bitcoin Cash SV(BSV) which still hasn’t developed the facility for backup and recovery so the user must remember the 12-word phrase/PIN, otherwise, he/she might end up losing the coins. It has developed a streamlined sending process, with a reset wallet function in their settings and scalability improvements recently.

How to Use Bitcoin SV?

The new token has just appeared on the crypto market and is already in top ten currencies. It is still a newbie, however, there are a couple of exchanges and wallets that support the new coin. As well as a dozen of services such as Bitcoin ATM, CashPay, Crypto Traders Pro, Premier Medical, Inc. and others.

The Future

As you can see, the Bitcoin SV team have a key focus on what they want to achieve in the future. More specifically, with its projection of hosting as many as 5 billion users per day due to its scalability, Bitcoin SV hopes to be a big dog someday, ending BCH reign in the process.

The roadmap for BSV continues to highlight the four key areas that the team will explore and sets out a clear plan for the development of Bitcoin SV right through to Q2 of 2019.

Bitcoin SV as an independent blockchain network is currently valued at $1.7bn. But its team needs to tread softly, and keep its infighting in check to stay on the path of professionalism and growth.

Summary

The success of the BSV will significantly depend on its adaptability both to miners and users. As the SV team claimed, it is time Bitcoin gets a mainstream acceptance, however, there are still major barriers on its way. Price fluctuation is the most problematic factor preventing businesses adopting bitcoin.