Bittrex is one of the largest cryptocurrency exchanges in the world. Based in Seattle, WA, it has been in operation since 2014. The platform currently lists hundreds of coins and hundreds of cryptocurrency trading pairs. But you might be really interested in whether or not there any cooperation between Bittrex and the Internal Revenue Service (IRS). Lets find out!

Bittrex Tax Reporting Policy

According to the official website, Bittrex does not provide any recommendations, consultation, or evaluations for:

- Legal advice or regulatory compliance,

- Tax planning, preparation, or filing. Bittrex does not provide tax forms or reports.

- Financial services or planning, and/or

- Trading or investment advice.

Customer identification, personal information, and records of deposits, withdrawals, and trading activity are confidential except as required by law or court order.

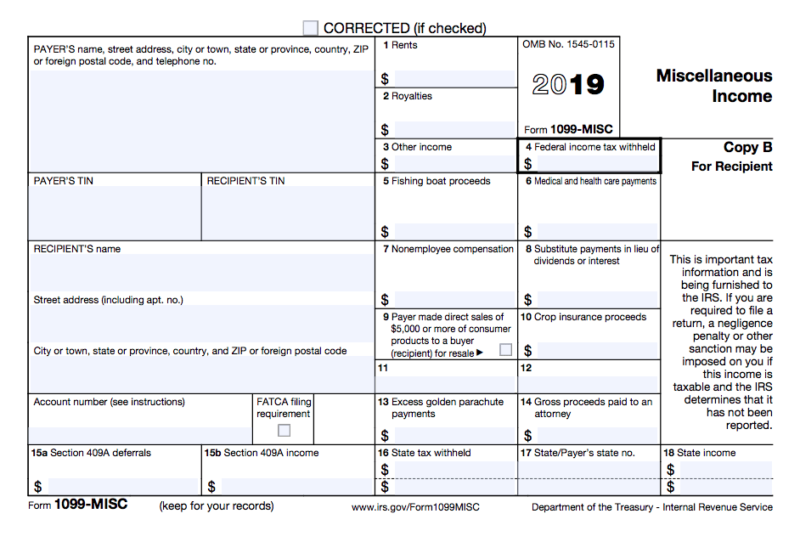

However, according to multiple forums, any and all information obtained on an individual by the agency is done by 1099 form. Some exchanges require your identification, some do not. The ones that do will file 1099 on your behalf if more than $10,000 has transacted under your account in accordance with FDIC. This includes any visa/MC branded BTC debit cards. The financial information contained is not available to any agencies unless disclosed freely by an individual.

When do I need to pay taxes?

As Internal Revenue Service guidance states “Bitcoin and all other “convertible” digital currencies (read altcoins) are taxed as property for United States income tax purposes.” As a general rule, any time property is either sold for USD or exchanged for another property in a barter transaction (such as Bitcoin for other convertible digital currency in this case), a tax event has occurred.

So we can conclude that you need to pay taxes when:

- you use cryptocurrency for goods and services.

- you convert your digital currency to fiat.

- you trade cryptocurrency to cryptocurrency.

The last one can be really tough. You make a profit when you sell, but the profit is not converted to fiat, and you still need to pay the tax for that profit. Crypto tax software like Bitcoin.tax and Cointracking.info come in handy as they provide various reports for realized and unrealized gains. On cointracking.info you can also choose several different options for calculating these numbers such as FIFO (first in first out) or LIFO (Last in first out):

- Export your trading operations in a .csv file from Bittrex and import it to cointracking.info.

- Go to Reporting—>,Realized and Unrealized Gains to see the amount for Realized and Unrealized Gains.

US-Based Exchanges

If the only place you ever bought your cryptocurrency is Bittrex, Coinbase, Gemini or any other US-based exchanges and you hold all of your cryptocurrencies in these exchanges or your private digital wallets (like Myetherwallet), then you may be a subject to FATCA rules.

Importantly, crypto-brokers are not required to issue 1099 disclosure forms — the ones used by the IRS to report income other than wages, salaries, and tips — which makes the process of reporting gains more difficult for crypto users. However, U.S.-based crypto exchange and wallet service Coinbase has sent the form to some of its customers. On the other hand, nobody has reported on Bittrex sharing any confidential information about its users.

The IRS has shown significant interest in cryptocurrencies as a source of revenue over the past few years. Moreover, the IRS allegedly uses software for tracking purposes and reminds crypto holders to pay their taxes via memos, highlighting the “inherently pseudo-anonymous aspect” of cryptocurrency transactions.

Summary

Nobody can promise you that Bittrex or any other US-based crypto exchange does not share (or will not do it any time in future) information about their clients’ transactions with government bodies like IRS. So our recommendation would be to file all the required forms (including Bittrex tax forms) and do not rely on luck.