There are multiple ways for you to purchase cryptocurrency. Did you know that you can actually buy Bitcoin in person? There are actually a few links between the digital world of cryptocurrencies and the physical world of cash.

Cash transactions have their associated risks. This is of particular concern since these days, the amount of cash necessary to purchase even a small amount of Bitcoin is significant.

Here, we bring you 8 ways to buy Bitcoin in person. Each method has its own risks. We hope that, should you choose to buy Bitcoin in person, that we can help you choose the method that is right for you!

Cash transactions have their own risks. This is of particular concern since the amount of cash necessary to purchase even a small amount of Bitcoin can be significant. The risk that comes from this reality may make some of these methods more attractive than others.

How to Buy Bitcoin in Person?

Here is a quick step-by-step guide on how to buy BTC with cash:

- Select a P2P exchange.

- Find a seller in your area who accepts cash.

- Select the amount of coins and place an order.

- Receive account number from the seller.

- Deposit cash into the sellers account.

- Upload your receipt to prove you made the deposit/trade.

- Receive your crypto coins.

Pros and Cons of Buying Cryptocurrency with Cash

| Pros | Cons |

| Quick | Typically, not the most cost-effective option |

| Convenient | You will generally be limited in the amount you can buy |

| Anonymous | Your platform options will be more limited |

Buying Bitcoin in Person

Meet a Bitcoin seller near you in person and buy crypto with cash in hand, or any other payment option you agree on. Just make sure you only meet in a public place and try to only deal with sellers that have a good reputation on the site.

LocalBitcoins

LocalBitcoins is a P2P Bitcoin exchange. Buyers and sellers agree on trade terms, and LocalBitcoins is used as escrow.

It is available in nearly every country. Liquidity will depend on the number of buyers and sellers in your area. LocalBitcoins is not available in Germany or the state of New York. LocalBitcoins left New York due to the BitLicense.

The difference between Local Bitcoins and most exchanges is that it does not require personal information when making good trades. Unlike other exchanges, which require ID verification and personal information, Local Bitcoins allows you to buy BTC without connecting your name to the bitcoin you’re buying.

Localbitcoins allows buyers and sellers to transact via a wide range of payment methods:

- COD or Cash on Delivery

- Cash via mail

- PayPal

- Webmoney

- Western Union

- Wire exchange

Localbitcoins also charges a commission of just 1% usually taken from the sellers (or individual who posted an advert).

PROS

- One of the most private ways to purchase crypto coins

- In some countries, it is the only way to buy BTC

- Buy digital currency with different payment methods

CONS

- There are many scams

- Fees can be slightly high when buying with cash, since many people are willing to pay extra for the privacy LocalBitcoins offers

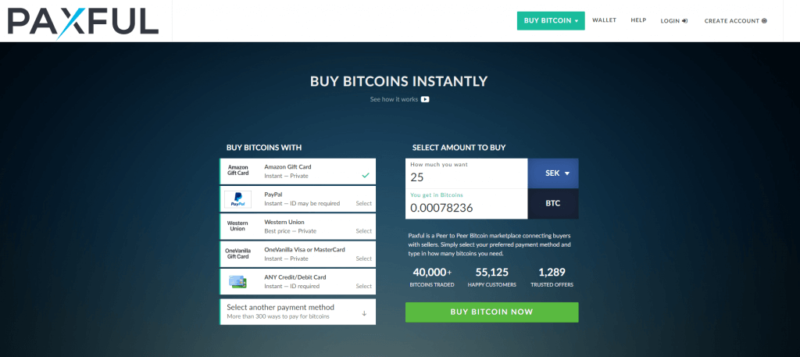

Paxful

Paxful operates as a mediator between interested parties and provides a space for its users to interact. It is very similar to LocalBitcoins, where anyone in the world can trade fiat for BTC or vice versa. The state of New York is the only exception and jurisdiction where they cannot operate because they do not have the required BitLicense.

Paxful is a popular option for trading cryptocurrency as the site is user friendly and offers the most diverse range of payment methods available online. Payment options include bank transfer, credit or debit card, PayPal, MoneyGram, and Skrill. In addition to these methods, users can also choose to make purchases by using any of a huge number of gift cards such as Amazon and iTunes.

The site is open to buy with any currency. However, only BTC may be sold. The supposedly cool thing about Paxful is that there are no fees for the BTC buyer. However, it’s a bit naive to say that there are no transaction fees because most sellers just portray these fees inside their exchange rate. It should be taken into account that for uncommon payment methods the conversion rate is usually far lower than the market price. In other words, this means that the buyer pays a commission to the seller.

0.001 BTC is the minimum amount that Paxful allows any vendor to offer, no matter their verification level. The site takes 1% from the total sale amount from the seller, taken automatically from the user wallet and sent into escrow along with the amount to be purchased by a client during a trade.

Pros

- Easily and quickly buy and sell BTC online.

- Accepts hundreds of payments that include cash, cards and Facebook.

- Buyers pay no transaction fees, while sellers pay 1%.

- Offers the potential for extra cash as Pay with Paxful affiliate.

Cons

- Exchange rates vary by seller — sometimes wildly.

- Sellers set maximum and minimum amounts.

- Delivery speeds depend largely on a sellers response time.

- Potential for scammers, so you must be vigilant.

Bitquick

BitQuick is a simple Bitcoin exchange that allows customers to easily buy or sell BTC using cash or SEPA transfers.

Given that this is a P2P exchange, the exchange is done directly from the seller to the buyer. The seller will list the coins that they would like to sell and then the buyer will communicate directly with the seller. Once a sale has been agreed, the parties will conduct the exchange and the escrow services of BitQuick will be used.

The only state that is excluded from this list is New York State. This is because of the implementation of the Bitlicence legislation in the state and the cost associated with obtaining a licence.

Although the vast majority of their volume is in USD for sellers in the US, they do have international support for traders in other countries. According to their website, they offer support for the following countries.

- USA

- Canada

- Europe

- Russia

- Australia

There is a 2.0% fee for buying with BitQuick. There is no fee for selling. The fees are deducted from the BTC amount before it is released. While this policy is plainly stated on their website’s FAQ section, it has received a few complaints on some review sites.

Pros

- Easy-to-use interface

- Headquartered in the US

- Full transparency

- Quick transactions

Cons

- Comparatively high fees

- Bitcoin buy prices often above market rate

- Site has been subject to a server attack in the past

Bitify

Bitify is a blockchain-based market platform that allows users to trade, auction or exchange goods and services that are payable through Bitcoin and Litecoin. The platform lists a wide range of products ranging from hardware, minerals, real estate, vehicles, gift cards and even foodstuff to the users from where they can purchase them using cryptocurrency. In addition to the peer-to-peer trading, users will also get the chance to participate in product auctions from where they can get items at a throwaway price.

The platform offers the following services:

- Escrow to build trust with the trading peers, BITIFY will use the trusted bitcoin escrow to hold the cryptocurrency until each party is satisfied with the trade

- Selling portal – users can list their items for free and earn a reward for contributing to the marketplace.

- Buying portal- customers in need of a listed item get to buy the product using Bitcoin or Litecoin form the great deals

Seller pay 4.5% (or 2.5% if they are a Super Seller) flat rate or transaction fee (whichever is higher) on sold items across the site, regardless of the price or the category the item is listed under.

If the seller selects to feature the listing when posting a new item, they will be charged an additional fixed at $0.50 on items under $10, $1 on items between $10-$20, and then calculated at 2.5% (min $1.50) on items over $20. If the listing does not sell, the seller is not expected to pay anything.

Buying on Bitify is free.

Pros

- Safety of the transaction with the use of escrow service to secure the trade

- Power to monitor the sale and delivery in real-time

- Fairer and Better value regarding low service fees and distribution of the product

- Less expensive fee system to ensure an appropriate charge for the payouts and refunds

- Competitive prices for the products

- Affiliate program for rewarding customers

Cons

- Only allow exchange using two cryptocurrencies

- Delivery depends on the buyers location

Wall of Coins

Wall of Coins is another marketplace where you can sell digital assets locally. The platform’s main purpose is to help users purchase or sell BTC in exchange for cash. The platform is convenient especially for users who are beginners in the process of buying bitcoins in person, as it has an SMS system that guides users through the entire process.

The Wall of Coins does not have restrictions on the method of payment that sellers can use to receive payments for their coins. For the buyers, however, they will have to confirm on the order book the payment methods that are accepted at that time.

Wall of Coins is currently available in:

- United States

- United Kingdom

- Argentina

- Australia

- Brazil

- Canada

- Germany

- Latvia

- Mexico

- Poland

- Philippines

- Romania

Although the site does not disclose its fees publicly, the price you pay is generally very low at about 1-2%. However, you may be subject to bank service fees when making cash deposits.

Pros

- Some of the lowest rates in the industry

- Strong privacy standards

- Cash deposits accepted

Cons

- Limited uptake in Australia may make buyers/sellers hard to find

- Difficult to buy large quantities of BTC coins

- Fees are not displayed publicly

LibertyX

Available for web and mobile, the LibertyX app provides a “Store Locator” link, making it easy to find participating LibertyX stores in your area.

The company has set up dozens of brick and mortar shops (or partnerships with existing ones) across the US. After having an account with them and having downloaded their app, one can go to the store and buy bitcoin with cash.

There are two types of stores the so-called “variable ones”, where one can pay directly, and the “PIN/Gift Card” ones, where, as the name suggest, you can buy vouchers for predetermined amounts.

The LibertyX app is free to download and use, and LibertyX charges no additional transaction fees for using the app.

When buying bitcoin with cash from a participating vendor, you may incur a convenience fee from the vendor. LibertyX lets vendors set their own fees, and this may vary from location to location, but all costs should be accurately displayed through the app on a store-by-store basis.

Pros

- Buy bitcoin with cash at participating locations.

- Fast transactions.

- You don’t need to sync a bank account to use LibertyX.

- Convenient Store Locator map is built into the app, allowing you to search your area.

- Trailblazer program rewards customers with $5 in bitcoin for being the first to use new LibertyX stores.

Cons

- LibertyX stores may not be conveniently available in all areas.

- In order to increase your daily maximum purchase to the bitcoin equivalent of $1,000, you need to provide additional personal information to LibertyX.

- LibertyX stores may charge convenience fees on transactions.

- Some LibertyX stores only process transactions in specified amounts, such as $5, $10, $20.

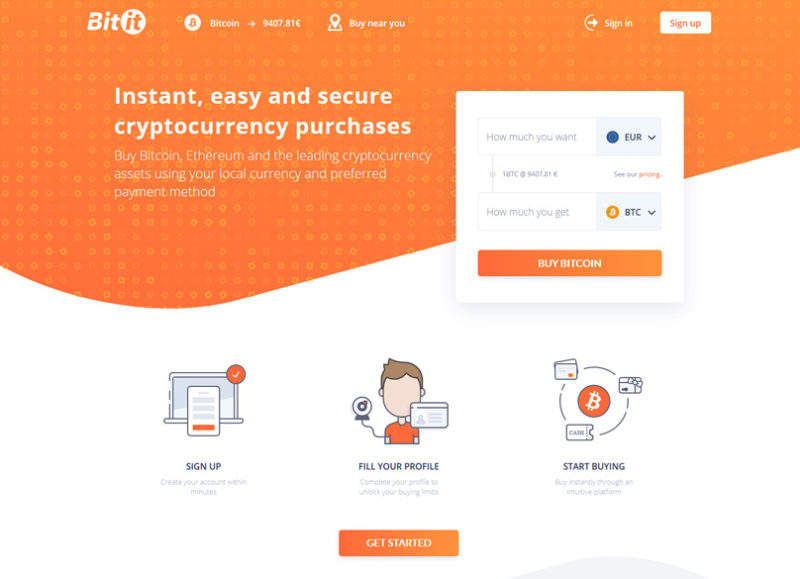

Bitit

BitIt is a cryptocurrency exchange platform based in Paris, France which allows you to buy leading cryptocurrencies in your local currency of choice and with the payment method you prefer.

The platform allows purchases in real-time thanks to direct payments, so you do not have to worry as much about exposure to the market’s volatility. Payments are always secure since they are developed, regulated, and hosted in France. BitIt follows the highest standards for both regulatory oversight and privacy.

One of the features that truly sets BitIt apart is its ability to accept a long list of payment methods you will not find on other cryptocurrency exchanges. Use credit cards, e-wallets, wire transfers, or even cash. Specific methods include Maestro, MasterCard, Visa, TrustPay, CashLib, and Neosurf.

Fees can be as low as 2.5 percent, so more of your money goes toward your cryptocurrency purchase, delivering a great value. Purchases will have a 3 percent fee with TrustPay, a 6.9 percent fee for buying online with a credit card, and a fee of 5.9 to 11.9 percent for payments with Neosurf or Cashlib. Remember, you may also have to pay fees charged by a store in exchange for a prepaid voucher or for foreign exchange or foreign transaction fees that your financial institution charges.

Pros

- Simple to use

- Pay with cash or credit card

Cons

- High fees compared to other services

- Strict per-transaction order limits

CoinATMRadar

CoinATMRadar is a website that compares more than 3500 ATMs worldwide. Bitcoin ATMs are now installed all around the world, most of them in the United States, Canada, Austria and the United Kingdom.

The ATMs (automatic teller machines) on CoinATMRadar are displayed on a map, each one with its own features.

When going to VIEW LISTING you can get the full profile: operator details, phone and email, machine details and ATM Type, Supported coins Fees, Limits and more.

Bitcoin ATMs allow people to either deposit cash which can then be turned into Bitcoin or to convert BTC into cash and then withdraw this cash. So essentially, ATMs make it feasible and convenient for people to turn their Bitcoin in to cash or vice versa.

This can be extremely convenient at shopping malls, in hotels, or in other locations where people may need cash and may want to withdraw funds from their Bitcoin wallets rather than from their bank accounts.

Some models of ATM will print out a paper wallet with a QR code on them, which you can then scan to send your Bitcoin to. You don’t even need a digital wallet! Other models of ATM will require you to have already downloaded a digital wallet to your phone.

The average fees for using ATMS are about 5-10%, although this can vary greatly depending on your country.

Pros

- ATMs are a convenient way to turn BTC into cash.

- With a Bitcoin ATM, it is possible to convert Bitcoin into fiat currency in a matter of seconds.

- There is no risk of a second party being unscrupulous.

Cons

- High fees.

- Might be difficult to find.

- issues with service reliability for ATMs.

Summing Up

If you are a bitcoin buyer or seller looking for meeting in person in order to get your crypto transaction, there are multiple options for you to choose from. However, it is reasonable to put personal safety at the top of the list of considerations when purchasing Bitcoin for cash.