Genesis mining was founded in 2013 an is one of the oldest Bitcoin companies around. It’s one of the most, if not THE most, well-known companies when it comes to cloud mining.

Genesis has a mining farm in Iceland. Users rent “hashing power” in the form of a two-year contract from Genesis for a one-time, upfront fee. In return, they receive daily payouts in the specific cryptocurrency they purchased in their contract. Now, of course, you want to know if cloud mining with Genesis profitable. Lets find out!

When you are signing the contract, you can see the upfront cost, however, you are unable to get an idea of how many coins you will get by the end of your contract. It mainly happens due to cryptocurrency volatility and future uncertainty:

- The price of the currency will fluctuate over time

- The network hash rate (the mining power of the entire network) will fluctuate over time as well.

How Does Genesis Mining Work?

According to their website, is an easy and safe way to purchase hash power without having to deal with the complex hardware and software set up.

All you need to do is set up an account with them to start mining. After signing up, fund your account via Bitcoin, PayPal, credit card, or wire transfer, and then choose the mining plan that’s best for you.

You can start mining cryptocurrencies on this cloud mining service with only 28 dollars in your pocket. That’s how much is the cheapest contract under which you become the owner of 2 MH/s.

The Most Profitable Currencies to Mine

There are about a dozen altcoins (Ether, Litecoin and others) on the resource Genesis Mining, except for bitcoin, and you can choose any of these currencies for cloud mining. But, of course, the question immediately arises what kind of currency to produce the most profitable returns? To determine the profitability of mining of a cryptocurrency, you can use some profitability calculator.

In other words, there is no universal answer. In each case, you need to calculate everything, taking into account the factors that affect this very profitability:

- the current value of the coin you are going to mine,

- the network complexity and how this complexity increases (in percent). The fact is that the situation is changing quickly enough and in order to “squeeze” the maximum profit from the purchased capacity, you need to constantly monitor the indicators you are interested in and adjust your work in accordance with their changes.

- the possibility of additional earnings on the affiliate program you have a chance to increase their capacity by attracting new customers to the project. Under the terms of the program, the user you provided will receive a 3% discount on the purchase of the tariff plan. As a reward, you will receive an increase in leased capacity. How much they will be increased depends on your grade in the system and referral order. At the first level, the partner receives 2.5% of the order of the client. For example, when you buy 200 GH/s for BTC mining, you are added 5 GH/s. To go to the next level, the users you provided must pay for all packages over 100, the third level is 500.

The data is calculated for the last 100 days, if referrals spend a smaller amount, the rank will decrease. The administration does not limit partners in legal ways to attract new customers. You can post your promo code or link to websites, blogs, social networking communities, comments on forums, your channel on video hosting, email mailing lists. It is recommended to pay attention to social networks like Facebook and Twitter, where you can find a lot of target users.

Possible Scenarios Genesis Mining ROI

Here are different scenarios to get a better idea of what could be and if it is worth it.

- Base — Assume no change in price or network hash rate for the duration of the contract

- Median — Run a full 1,000 trial simulation of prices and network hash rate, and use the median values for each

- Conservative — The same as Median, but instead use a price forecast that is 1 standard deviation below the median price

- Aggressive — The same as Median, but instead use a price forecast that is 1 standard deviation above the median price

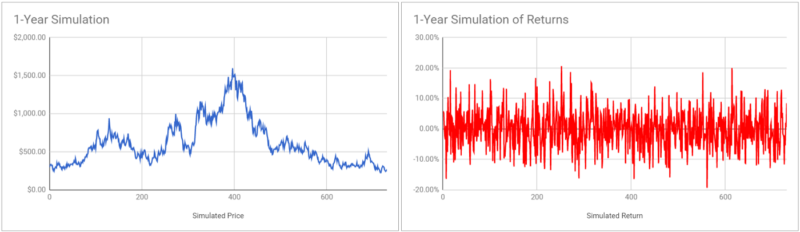

Cost and Returns Simulation

Here we can see one of the 1,000 price simulations run to inform our forecast for the Median, Conservative, and Aggressive scenarios.

Base Price: $298.85 Median: $1079.74 Conservative: $338.91 Aggressive: $3,761.41*

Why is the price so high? This is what happens when you have a volatile currency in a simulation that does not have changes in volatility. When a currency can move 20% in one day, it is not uncommon to see price movements like this. Ethereum could easily grow 25x in one year.

Base performance ranges from 30% to 39% ROI and is higher than the Median scenario by ~10%. While the conservative scenario shows a loss of between 59–62%, and the aggressive scenario shows a gain between 318% and 347%.

Who is Genesis Mining for?

- Future Miners: Those who want to become more serious cryptocurrency miners in the future.

- Gamblers: The cryptocurrency market is extremely volatile and investing these kinds of websites, no matter how legitimate is very risky.

- Can afford to lose the money: Those who invest too high sums tend to be emotionally attached which prevents them from thinking rationally when the market tanks or soars.

Conclusions

The initial upfront costs and potential profitability are hidden when investing in hashing power contracts like Genesis Mining.

However, with some robust analysis, we can get a better idea of how to assess the potential profitability of a two-year deal.