Market Capitalization, or Market Cap, is one of the best measures to indicate the size of a company. It is calculated by taking the price per share (of stock) and multiplying it by the total outstanding shares. It is a well-known metric for traditional securities, but it also has unique implications for cryptos as well.

What is Market Cap in Cryptocurrency?

Market capitalization is a measure of the value of security. It usually consists of multiplying the number of outstanding stock shares by the current stock price. In crypto, it’s defined as the circulation supply of tokens multiplied by the current price. If a coin has 100 tokens outstanding and is trading for $10 a coin, it has a market cap of $1000. There are around 17.4 million bitcoins in existence, and the price is around $6380 at time of writing. Bitcoin’s market cap, therefore, is roughly $112 billion. So it gives us the following formula:

Market Cap = Current Currency Price X Circulation Supply of a Cryptocurrency

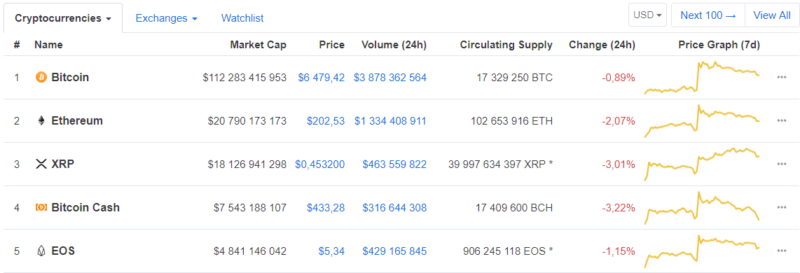

By market cap, Bitcoin is still the biggest cryptocurrency, with the current market value exceeding an enormous $112 billion, while Ethereum has a market cap of $20 billion, reclaiming its position as the second largest crypto after Bitcoin.

Because the market caps of Bitcoin, Ethereum and Ripple are the same order of magnitude, large unit currency price increases/falls can occasionally result in Ethereum being pushed into third place and Ethereum/Ripple closing the gap with Bitcoin.

The difference between Circulating Supply, Total Supply, and Max Supply

- Circulating Supplyis the best approximation of the number of coins that are circulating in the market and in the general publics hands. It is the number of units of a specific currency available in the market at any given time. It might well be less than the total supply, given some of the coins may still be held (and therefore not in circulation) by the creators of the currency. Ripple is a classic example where the circulating supply is only about 28% of the total supply.

- Total Supplyis the total amount of coins in existence right now (minus any coins that have been verifiably burned).

- Max Supplyis the best approximation of the maximum amount of coins that will ever exist in the lifetime of the cryptocurrency.

Why Market Cap is More Important than Price?

Market Cap usually shows us the amount of investment risk involved. Stocks categorize broadly as small cap, mid cap, and large cap as the market cap increases.

- Large cap companies like Apple, Amazon, Walmart, or Home Depot present less risk to the investor. But growing to a certain size limits a company’s growth potential.

- Small cap companies inherently present more risk because of potential company failure. However, they yield tremendous reward to early investors when they succeed.

You can also use market cap to take snapshots of company or cryptocurrency groupings. For instance, take all the companies in a given sector (technology, retail, manufacturing) and calculate each company’s market cap, then add them all together. That gives you the market cap for that sector.

Similarly, do the same for a group of cryptocurrencies. Take the privacy coins, for instance, calculate their market caps, and add them all together. That number gives you a picture of the value of the privacy coin space.

You can learn a lot about crypto just by checking market caps. A high or low market cap can reveal a coin that is resistant to volatility, or vulnerable. Coins with small market caps consequently rock more when big news hits the market, or “whales” (large buyers) take positions. That isn’t inherently surprising – the crypto markets are among the most volatile the world has ever seen. But holders of tokens with small market caps are at risk of being crushed by larger traders. If several whales conspire to sell at the same time, the price of a token can crash to nothing instantly. This would be much tougher with Bitcoin and Ethereum, which have large volume and are not easily manipulated.

Bitcoin and Ethereum broke into mainstream news this year with the massive increases of their respective market caps. They, and the third coin on Coinbase, Litecoin, have all seen a boost recently. Coinbase announced customers with US bank accounts would be able to make instantaneous purchases, which was previously limited. All three coins saw a boost in their respective market caps with this news.

Fundamental analysis

The market cap approach belongs to the fundamental analysis field of stock market investing. Fundamental analysis seeks to calculate the value of a company to determine future rewards. This strategy involves long-term thinking and looks for growth in value over time.

Technical analysis

Technical analysis focuses on short-term trends, and price fluctuations play a more important role than long-term valuation. If an investor using technical analysis believes the price of a stock or cryptocurrency will skyrocket over the next week, that constitutes a good short-term investment regardless of market cap. The value could sink to zero next year, but a short-term investor would not care.

Conclusions

Cryptocurrency market capitalization is both a quick way to gauge a coin’s value, and a more than it seems. A healthy market cap is indicative of a strong coin, but developers or whales holding coins can mislead. Always weigh market cap with some of the other metrics before making an investment decision.

Sources

Competition in the Cryptocurrency Market Neil Gandal, Hanna Halaburda

Systematic risk in cryptocurrency market: Evidence from DCC-MGARCH model Nguyen Phuc Canha, Udomsak Wongchotib, Su Dinh Thanhc, Nguyen Trung Thonga

Some stylized facts of the cryptocurrency market Wei Zhang, Pengfei Wang, Xiao Li Dehua Shen