Bitcoin keeps getting more popular every day, and there are millions of people all over the world who own it. And, when tax season comes, you have to file your taxes. By the way, don’t forget to mention your Bitcoin transactions, as bitcoin is regulated in most countries, including the US. This is where a Bitcoin tax calculator will undoubtedly be useful, and necessary!

The Internal Revenue Service (IRS) recognizes any income generated by trading cryptocurrency, or accepting cryptos for goods and services, as taxable. So, it is mandatory to include your crypto gains with your tax returns before midnight on April 15th. To be safe, most traders are filing their cryptocurrency gains according to the instructions and guidelines issued by the IRS. There are a couple of tools on the market to calculate your taxes on crypto trades by integrating your exchanges securely and downloading a gain/loss summary. They provide a Form 8949 for capital gains.

Not much is certain when it comes to cryptocurrency tax law. What is for sure: Bitcoin gains are taxable. Income, no matter if it is in national currency or digital currency, is taxable unless the IRS states differently. Indeed, U.S. citizens could be liable for taxes on their trading, holding, spending, mining, gifting, tipping and donating of crypto coins.

Luckily, there are numerous tax calculators that make Bitcoin tax reporting easier, as they keep track of digital currency cost and profits for all of your crypto activities mining, buying, trading, etc.

How to Calculate Bitcoin Taxes?

To properly pay taxes on an investment in Bitcoin, you’ll need to wrangle some information from each transaction you conducted over the last fiscal year. This includes the basis for each amount of BTC you sold, the date you bought it, the date you sold it, and the price at which you sold it.

This IRS guidance is subject to interpretation, but for most people the main things to consider from a tax perspective are:

- How long you held your Bitcoin or other cryptocurrencies from purchase to sale? If held for less than a year, any profit may be liable for short-term capital gains tax. If held for longer than a year, any profit may be liable for long-term capital gains tax.

- What is your tax filing status and taxable income? That will determine your tax bracket and the tax rate on any Bitcoin profits.

- What is your state tax rate? That will determine how much you will owe in state taxes.

You can also use the dates to figure out whether the specific sale qualifies as a short-term gain or a long-term gain (if you are not sure about Bitcoin terminology, our post will be really helpful). Short-term gains are taxed like regular income, so the rate is equal to your federal income tax bracket. Long-term gains are taxed at a lower rate, but still according to your income level.

Bitcoin Tax Calculator Instructions for U.S Residents

If you are not sure how much is Bitcoin tax and how to calculate crypto taxes, the following guide will be handy:

Enter Your Personal Details

- Select the tax year you would like to calculate your estimated taxes.

- Select your tax filing status.

- Enter your taxable income excluding any profit from Bitcoin sales. For most people, this is the same as adjusted gross income (AGI).

- Enter your state tax rate.

For each Bitcoin sale within a tax year

- Enter the purchase date and purchase price. The purchase date can be any time up to December 31st of the tax year selected.

- Enter the sale date and sale price. Make sure the sale date is within the tax year selected.

- Repeat for all Bitcoin or cryptocurrency sales within the tax year selected.

To help you to identify how much you owe in capital gains tax on your Bitcoin investment income, you will find the four best cryptocurrency tax calculators in this article:

- Cryptotrader.Tax

- BitcoinTaxes

- CoinTracking

- LibraTax

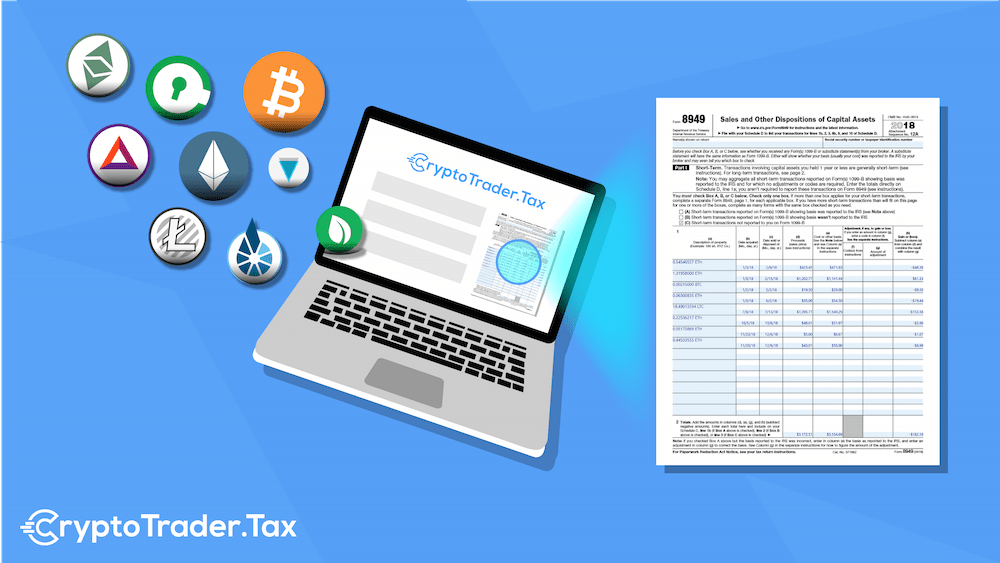

1. CryptoTrader.Tax

CryptoTrader.Tax is a crypto tax management software built to automate the entire crypto tax reporting process. Simply import your crypto trading and transaction history into the platform, review the data provided, and create an accurate tax report in minutes. This tool supports all major exchanges operating nowadays, so it is very easy to import trade history and use it for all types of tax reports. Users can import their cryptocurrency tax reports directly into TurboTax as it is a partner of the company too.

CryptoTrader.Tax does not limit its users on the number of cryptocurrencies supported and allows completing the tax report compilation process quickly and integrating it with other tax solutions. Moreover, they provide a money-back guarantee for all users if you are not satisfied with your tax report.

History

Despite the fact that this service has been operating for a short period of time, it provides reports before 2017 and even offers a 25% discount for clients who order tax reports before 2017. Users can generate historical reports all the way back to 2010. It continues to develop and add new features regularly to eliminate efforts required for tax reports.

Fees

You can get started at CryptoTrader.Tax absolutely free of charge and import both your trade history and crypto income. But if you want to export your report, there are three plans offered to clients. The choice and price of the plan depend on the number of trades made. Hobbyist plans include up to 100 trades and cost $49 per tax season. The Pro Trader plan includes up to 2,500 trades and costs $99 per tax season. Users with over 2,500 trades should apply for the High Volume Trader plan which costs $199 per tax season. You can also use the coupon code CRYPTOTALK10 for a 10% discount on your entire tax report.

Registration

Users can sign-up for the CryptoTrader.Tax platform free of charge. The only information required is an email address and a unique password to be repeated twice.

Supported cryptocurrency

When it comes to the number of crypto coins supported by the platform, in fact, there are no restrictions. It makes no difference what coin was traded and brought about gains or losses. Each of them can be added to the tax report.

Tax reporting

It is very easy to prepare a tax report using this service since it is enough to import your trading and transaction history as well as choose one or several report types supported. All the data is calculated for you by the software so there is no need to do anything manually. Moreover, you can download your tax report file in CSV, PDF or Excel formats as well as import it into TurboTax software. Currently, it is possible to order an Audit Trail Report, IRS Form 8949, Short Long Term Gains Report, Cryptocurrency Income Report and others.

Exchanges supportedFeatures

The list of features characterizing Cryptotrader.Tax is quite extensive including the following ones:

- Tax management: a possibility to manage your gains and losses brought about by dealing with cryptocurrency,

- Trade import: files of CSV format can be easily imported from 24 exchanges. Additionally, there is an automatic API import as well as a possibility to export CSV, PDF, and Excel files,

- Multiple algorithms used for calculating (according to FIFO, LIFO, and others),

- Import to TurboTax and other platforms,

- User-friendly interface which is intuitively understood,

- Accuracy of data stored in the enormous historical database of all cryptocurrency prices,

- Affiliate program rewarding 25% recurring commission,

- 10% discount on all tax reports with the coupon code CRYPTALKER10.

Read full CryptoTrader.Tax Review

2. CryptoTax.io

CryptoTax is in a pre-launch in the US and the official start of the service is planned in October of this year. Therefore, the company offers all its new clients with an opportunity to get free tax reports for 2019 if they register on the service before its official launch. Additionally, all new users can participate in the lottery and get a chance to win a refund on their crypto taxes. The deadline for registering is October 18, 2019, so it is time to hurry to take advantage of this free offer.

History

CryptoTax was founded by former KPMG employees in 2017 in Germany with the goal to develop crypto tax reporting solutions for individuals and organizations. The tax reporting application was launched in Germany in May 2018. The next big step forward was launching this application in Switzerland and providing a generic tax reporting solution for other countries in the beginning of 2019. Now it is considered to be the leading tax reporting provider in Europe. At the moment, the company is also trying to take US markets by storm and suggest Americans its high-quality product.

Fees

CryptoTax offer free tax reports for 2019 for the new US users registering before October 18, 2019.

Thereafter it will also be a free plan, but only if there are fewer than 50 transactions altogether. For those with more transactions there are the following plans:

- Pro plan: up to 10,000 transactions in a tax year with free support will cost $199,99 (one-time payment).

- Unlimited plan: with the unlimited number of transactions in a tax year with free support will cost $599,99 (one-time payment).

Registration

It is easy to register for service, just provide your active email address and a password. You can also use the service completely anonymously by providing an anonymous email address. The system will send you a letter of confirmation where you will follow the link and activate your registration.

Supported cryptocurrencies

CryptoTax partners with CoinMarketCap to provide reliable rates for 8k+ most popular cryptocurrencies including Bitcoin and Ethereum. The application automatically calculates gains and losses according to the legal requirements.

Exchange and wallet tracking

The app allows importing data from all leading exchanges and wallets like Binance, Bitfinex, BitMEX, Bitpanda, Bittrex, Bitcoin Wallets, Coinbase, Coinbase Pro, Cointracking, Ethereum Wallets, EtherDelta/ForkDelta, Kraken, Poloniex and many others. However, even if you used any other exchange, the service offers generic CSV XLS import for all other sources.

Tax reporting

It is very easy to prepare a tax report using this platform. You need to export your report from the exchanges you use and upload them to the website. All the account transfers are detected automatically and deposits are linked with withdrawals. Users get a set of comprehensive tax reports with all the required forms. Moreover, it plans to launch FBAR and FATCA forms in the nearest future.

Features

CryptoTax offers the most comprehensive set of features and supports all relevant tax events for crypto traders, investors and users:

- Airdrops, ICOs, Hard Forks, OTC Trades, Swaps and income from Lending, Staking, Masternodes, and Bounties

- Proper tax consideration of both business and hobby operations (Mining, Staking, Masternodes, Lending and Bounties)

- Margin Trading

- The tax logic has been developed and approved by a Big 4 accounting firm to ensure maximum legal compliance

- Automated detection of account transfers

- Separate calculation of the cost basis for each account.

3. BitcoinTaxes App

BitcoinTaxes (Bitcoin.tax) is one of the most popular calculator apps. It supports importing for most exchanges and wallets, and provides an accurate transaction ledger. In addition, it can also import transactions directly from an address and the blockchain. Various cost methods allow for quick comparisons and lead to numerous export options that include a Form 8949 statement, printed Form 8949 PDF, and files that can be imported into TurboTax and TaxACT.

With support for most common exchanges and wallets, BitcoinTaxes will calculate and export tax reports no matter the amount of BTC or altcoin activity. Importing is straightforward and multiple calculations allow a choice of capital gains values. The reports and exports integrate with other tax e-file services, ensuring coverage for any taxpayer’s filing choice.

History

BitcoinTaxes, previously known as Bitcointaxes.info, was launched in February 2014 and was the primary service for the 2013 tax season. A significant update at the beginning of 2015 added more features for the 2014 tax season including new imports, income and spending calculators, and a blockchain viewer.

Fees

A free version includes all standard functionality, importing, calculation methods and all reports and exports. It does not not include the address monitoring and there is a limit of 100 transactions. An unlimited version is available for $19.95, payable by bank card or BTC.

Registration

You can sign up either with a Google account or an email address. The email address does not have to be real, if you are concerned with privacy. However, a real address would need to be used to receive any website updates.

Supported cryptocurrency

Alt-coins, e.g. Litecoin, are treated no different than Bitcoin and transactions are added into the table as they were traded. This includes any coin to coin trades, for example, DOGE/BTC or XRP/BTC. This, in comparison, is a significant failure of LibraTax, which does not maintain the original base price of the currency pair and ignores any non-BTC markets.

Importing Wallets and Addresses

The Spending tab imports wallet files from the Core wallet software, used by Bitcoin and many altcoins, as well as from Blockchain.Info. Once all transactions are imported, one or more can be selected and marked as a transfer. This marks the receiving address as an owned address and also re-categorizes any other transactions to or from that address.

Owned addresses are displayed in the Address tab, which is available to paid users. Addresses are automatically added from imported transactions or can be added manually, although currently only for BTC, LTC or DOGE.

Income

Any income or mining transactions are included in a mining report, that summarizes each income type as well as totals for each mined coin. The mined coins’ values are calculated and totaled, ready to be included as part of income data in either Schedule C or in Line 21 of Form 1040.

3. CoinTracking App

CoinTracking is one of the most feature-rich cryptocurrency portfolio and tax trackers that offers a web based platform as well as a mobile app for both Android and iOS phones. They also provide reporting for tax purposes, which is a huge benefit considering governments are going to start cracking down on people avoiding paying taxes on their gains.

History

The founder of Cointracking.info, Dario Kachel, started the business because he tried to track coins and gains using an Excel spreadsheet as a trader. Using this method, Kachel found many disadvantages of using the spreadsheet, and it led him to create his cryptocurrency-centric startup in April of 2013.

Fees

There are 3 different account plans for CoinTracking. The types are Free, Pro, and Unlimited. The screenshot below summarizes the features of each. You can buy 1 year, 2 years, and lifetime subscriptions. Note that even though the Free version has an “X” for tax reports, it will let you run a tax report as long as you have less than 100 trades!

Supported Cryptocurrency

CoinTracking supports thousands of cryptocurrencies, including Litecoins, Namecoins, as well as more obscure digital currencies like Terracoins and Devcoins.

Exchange and Wallet Tracking

CoinTracking makes tracking your transactions from Exchanges and wallets very simple. The two primary ways to import transactions are manually by using a CSV file, or automatically by using an API.

It supports over 5,000 digital currencies and supports 25 exchanges, which is very valuable for active traders who use several exchanges and hold a broad portfolio of digital assets. Armed with this information, CoinTracking then generates a tax report for you relevant to your jurisdiction.

Even though the CSV method is manual, they provide clear instructions for how to export a report from your exchange or wallet and then upload it. Note that even if your exchange is not on this list you can still format a CSV file with trade data and upload it.

Tax Reporting

This program provides a lot of different options for preparing a report, so you can easily generate one that will fit your reporting needs. The screenshot below shows the options available when generating a tax report on CoinTracking. It provides different tax percentages, various pricing and accounting methods, and even allow for calculating margin trades.

Once you run a tax report, you will have the option to load the regular report or load a very detailed version. It also separates out Income, Capital Gains, Gifts, Lost/Stolen, etc. into their own separate reports. The screenshot below is an example of the capital gains section. Notice the options for exporting in Form 8949, TaxAct, and TurboTax compatible formats.

Features

- Personal analysis – This group of features offers a myriad of interactive charts, where you can monitor the state of your trades and coins. You will also receive calculations of key indicators that provide a thorough insight into your profit/loss, balances, and coin value. This will, in turn, enable you to better grasp your realized and unrealized gains.

- Trade Importer – The platform offers effortless CSV import from 24 exchanges, plus automatic API import. The system directly synchronizes with the blockchain and even offers export in PDF, Excel, XML, CSV, and JSON.

- Trades – The software will keep a complete list of your trades and fees, grouping them by exchange and allowing interactive search and the comment function.

- Coin charts and analyses – CoinTracking is definitely worthy of that name, but its tracking capability also extends to the past. Namely, it keeps history charts of all 4532 virtual coins while also always providing the latest prices for each one. It also provides a list of top coins by volume and by trade, along with an experimental Bitcoin forecast.

- Tax declaration – All trades will be calculated according to FIFO, HIFO, LIFO, and LOFO and prepared for your accountants and the tax office. The algorithm also incorporates fee consideration and variable parameters, depending on your country of residence.

4. LibraTax App

LibraTax is another popular taxation solution and among the best tax software for investors in the world of digital currency. It allows users to keep track of all their cryptocurrency transactions by automatically retrieving the user’s historical sales and purchases of Bitcoin from the blockchain and reconciles them with the real-time value of the digital currency. The software also allows users to date back transaction for previous years for those who desire to amend tax returns from prior years to keep the taxman happy.

History

LibraTax was launched as Beta in August 2014 just before the final 2013 October tax filing deadline and has been through several iterations, both adding and removing functionality, ready for the 2014 tax filing season.

Fees

LibraTax is not a free tax calculator, but it has a free trial version where you can import up to 500 transactions. It provides access to all supported data imports, a transaction ledger, and summary totals for the various cost methods.

A payment of $19 payable by card, and recently Bitcoin, increases the limit to 5,000 transactions and provides access to a downloadable Tax Report.

Registration

Signing up is done with an email address and password. The email address doesn’t need to be real as it isn’t validated and is not used in any notifications or marketing.

Supported cryptocurrency

BTC-e is the only LibraTax import that supports trading of alt-coins, such as LTC, PPC and NMC. LibraTax does claim to work with all digital currencies, but this does not seem to be the case. Transactions in the LTC/BTC market are included but always represented as BTC/USD transactions, so the cost basis of LTC is lost. In addition, LTC/USD trades are simply ignored and don’t even get included within the transaction history.

Importing Wallets and Addresses

When importing the Blockchain.Info wallet using the API, LibraTax requests the wallet’s Id, password and also prompts to disable the two-factor authenticator.

LibraTax can import individual addresses, which is simple and quick, although only supports Bitcoin addresses, and only the latest 1,000 transactions. This should be enough for most people, as long as that limit is increased each year.

Income

Each imported address can be flagged as an income/mining address, where incoming transactions would be marked as Income, using the daily price. This sets the cost basis as if there had been a purchase, but also includes them in the final income total.

Cryptotrader.Tax vs BitcoinTaxes vs CoinTracking vs LibraTax

Tax Calculator

Advantages (+)

Disadvantages (-)

Cryptotrader.Tax

CryptoTrader.Tax support all cryptocurrency exchanges. You can build your tax report easily in 5-steps and send it to your accountant with the click of a button (tax reports are accurate down to the minute). All the data is calculated for you by the software so there is no need to do anything manually. You dont have to pay for the software until everything looks accurate.

To use the full functionality of the Cryptotrader.Tax you need to buy a paid plan.

BitcoinTaxes

Feature rich and capable of handling all Bitcoin and altcoin tax calculations for capital gains, income, mining and spending. Multiple cost basis methods, including FIFO, LIFO and cost averaging, as well as like-kind calculations. Multiple reports for gains, income, donations, and exports to TurboTax, TaxACT as well as generating Form 8949 PDF or statement.

Tabbed interface could require uploading the same files twice for trading and spending. Free version only supports up to 100 transactions and does not include address monitoring.

CoinTracking

CoinTracking is probably the best solution to calculate your digital currency investment income, especially if you have a large diversified portfolio. Using CoinTracking is easy and not risky. Access to your own crypto-assets is secure, data is read only but not written.

To use the full functionality of the tool you need to buy a premium package and this is quite expensive.

LibraTax

Simple interface with FIFO, LIFO and an optimized cost basis method for minimizing capital gains. Integrated with BitGive assisting in highlighting tax benefits from making charitable donations.

Inconsistent and inaccurate importing often requiring substantial manual editing. Payment is required before viewing or accessing the downloadable CSV file for Form 8949. The CSV file contains simple rounding errors and cannot be imported into e-File tax software. It is only relevant to those who file their taxes in the U.S.

Summary

Understanding the basics of taxes is important not just for paying taxes, but also to help you plan your trading strategy and to avoid unpleasant surprises.

Cryptocurrency trading is conducted in an extremely volatile market, making it rather daunting to keep track of your current profit/loss balance across all the exchanges/markets you might be utilizing, searching for the most opportune rates. Having good tax software can be essential, as it will help you with the Bitcoin day trader tax.