Launching a cryptocurrency exchange and trading business is no picnic! But, there are many people who have turned the art of trading cryptocurrencies into a science. Even if you are a newbie, you can quickly enhance your trading profits with the help of crypto trading bots. These software tools will help you trade cryptocurrencies more efficiently, and even profitably. Are you interested? Lets take a look at our list of best Bitcoin trading bots.

What is a Trading Bot?

In the middle of 20s century there were talks that robots would soon eliminate the daily chores of housewives across the globe. And now bots, cyber counterparts of robots, are promised to do the same for crypto traders. If the hype is to be believed, these bundles of code can deliver a passive income for even the laziest or dumbest of traders. However, the hype is never to be believed, as profiting from bots isn’t that simple or easy as it may seem.

The cryptocurrency market differs from traditional markets i.e. the stock market, in that it is open 24/7. On one hand, a market that is continuously open means that there might be more opportunities on which one can capitalize. On the other hand, humans need sleep, and the market can just as easily fall rapidly during this time of rest. As a result, a high frequency bot is increasingly becoming popular amongst traders that want to remain in control of their market activities all the time.

Bitcoin trading bots are programs that perform cryptocurrency trades like humans do, but bots do it independently and it can operate continuously without having rest and time limit.

Bots use various indicators to recognize trends and automatically execute trades. While algorithmic trading software has been used by hedge funds in the equity, commodity and currency markets, bots for private investors first appeared in the foreign exchange space. They have quickly made their way into the crypto asset market.

There are currently dozens of trading software types. They range from free bitcoin trading bot that anyone can use to expensive subscription bot services for professional crypto day traders. However, even the most popular bots vary in quality, usability, and profitability.

Bot using software to talk to an exchange via an “API” to place, buy and sell orders for you. It is done in both cryptocurrency and other types of trading. It is fully legal and welcome on most cryptocurrency exchanges, however, only specific brokers outside of cryptocurrency allow it.

What is an API?

An API, or Application Programming Interface, is an interface for an application that allows it to send and receive specific types of data. For example, it can be a way for your bot to interface with the exchange to place buy and sell orders and to collect price and balance data.

How Do Bitcoin Trading Bots Work?

Each bot represents a set of indicators and parameters that when all align will make a buy or sell signal, telling the exchange of your choice to execute a trade. Most of the time a bot is tuned for a specific market and time period, this is the creators best educated guess on how the market will work in the future.

You should realize that it is not a magic crystal ball that will make perfect trades every time and thus make you rich. Robot is like your assistant who gives you advice. But it’s up to you to follow it or not.

Depending on the time frame and what your bot is looking for you could make a lot, or lose some. This is after all a free market and not a bank. There are large unknowns when dealing with markets, any number of influences can trigger a rise or fall. Most programs will be a better strategy than a buy and hold method and as long as you believe your choice of altcoin will go up, then you will likely make a profit.

Trading robots work in a variety of ways, some through browser plugins, OS clients, trading servers or those infused in cryptocurrency exchange software.

In regard to a strategy of trading, many works by exponential moving average (EMA) as a starting point. EMAs track markets over a set of time and bots are programming to react to that price’s change — or act further when the price behaves in a certain way such as moving beyond certain thresholds.

Some programs work on the basis of a tweaked EMA approach, for instance, using DEMA [double exponential moving average] or TEMA [triple exponential moving average]. These can respond faster than EMA-based bots.

Other bots use relative strength indicators and regression analysis methods especially useful for unstable markets.

Sometimes a bot is used to help reduce lost, not just make profit. If a program is not preforming the way you think you can always change bots or pause it and make a manual trade and then turn the bot back on when it is in sync with your choice.

Benefits of Algorithmic Trading

- Trades executed at the best possible prices

- Instant and accurate trade order placement (thereby high chances of execution at desired levels)

- Trades timed correctly and instantly, to avoid significant price changes

- Reduced transaction costs (see the implementation shortfall example below)

- Simultaneous automated checks on multiple market conditions

- Reduced risk of manual errors in placing the trades

- Can be back tested, on available historical and real-time data, to see if it is a viable trading strategy

- Reduced possibility of mistakes by human traders based on emotional and psychological factors

Types of Trading Bot Strategies

There are several types of bots available including bitcoin arbitrage bots that capitalize on the difference in prices across exchanges. The price of bitcoin usually differs from exchange to exchange, Bitstamp, for example, typically displays a slightly lower price than Bittrex. The movements of bitcoin and other cryptocurrencies is always mirrored across exchanges, however, so if BTC breaks out due to a massive buy order on Binance, you can bet that the other exchanges will follow suit. Bots work by profiting from the delay it takes for prices to update across all exchanges.

Traders can make use of bots to implement a variety of market strategies, including:

- Arbitrage

This strategy is best understood as a trader taking advantage of the price differential that can exist between two markets, or in this case between cryptocurrency exchanges. With arbitrage, a trader would purchase a digital asset in one exchange, and simultaneously sell it on another exchange. Arbitrage was an effective strategy during the earlier days of the market, as there were often large price differentials on varying exchanges. However, the spreads found with this strategy have tightened up as the market matures.

- Market Making

Bots are also useful for the market making strategy, which involves the continuous buying and selling on a variety of spot digital currencies and digital derivatives contracts, all done in an effort to capture the spread between the buy and sell price. In other words, market making involves the placing of limit orders around the current market price of a digital asset, on both sides of the order book (so the buy and sell orders). With time, as the price of the digital asset fluctuates, the trader can profit from that resulting spread.

- Trend Trading

Robots can also be programmed to identify trends of a digital asset, and execute buy and sell orders based on them, which makes them especially effective for trend trading. This is a strategy that tries to capture gains through the analysis of an asset’s momentum in a given direction. To put it simply, trend traders will enter into a long position when an asset’s momentum is trending upward, and enter into a short position when it is trending downward.

- Mean Reversion

This strategy functions on the assumption that there is an underlying stable trend in the price of any given asset. It presumes that, whilst the price of the asset can fluctuate around this trend, it will eventually revert toward its mean or average. This mean or average could be the historical average of the price or return of the asset. This can form part of a strategy in that a trader can execute buy or sell orders on the presumption that the price of a given asset will revert back to its mean or average.

- Index Fund Rebalancing

Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. This creates profitable opportunities for algorithmic traders, who capitalize on expected trades that offer 20 to 80 basis points profits depending on the number of stocks in the index fund, just before index fund rebalancing. Such trades are initiated via algorithmic trading systems for timely execution and best prices.

- Mathematical Model Based Strategies

Proven mathematical models, like the delta-neutral trading strategy, allow trading on a combination of options and its underlying security. (Delta neutral is a portfolio strategy consisting of multiple positions with offsetting positive and negative deltas – a ratio comparing the change in the price of an asset, usually a marketable security, to the corresponding change in the price of its derivative – so that the overall delta of the assets in question totals zero.)

- Volume Weighted Average Price (VWAP)

Volume weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using stock-specific historical volume profiles. The aim is to execute the order close to the Volume Weighted Average Price (VWAP).

- Time Weighted Average Price (TWAP)

Time weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. The aim is to execute the order close to the average price between the start and end times, thereby minimizing market impact.

- Percentage of Volume (POV)

Until the trade order is fully filled, this algorithm continues sending partial orders, according to the defined participation ratio and according to the volume traded in the markets. The related “steps strategy” sends orders at a user-defined percentage of market volumes and increases or decreases this participation rate when the stock price reaches user-defined levels.

- Implementation Shortfall

The implementation shortfall strategy aims at minimizing the execution cost of an order by trading off the real-time market, thereby saving on the cost of the order and benefiting from the opportunity cost of delayed execution. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely.

TOP-10 Bitcoin Trading Bots

There are numerous trading robots on the market and all of them differ significantly from each other with respect to functionality, quality, profitability, and usability. In the following section, we take a look at some of the most popular bots that are currently operating in the market.

Cap.Club

Features:

- Professional tools,

- Free of charge,

- Used on 3 main trading platforms,

- Suitable for beginners and experienced traders,

- Customizable visual editor,

- High processing speeds,

- Excellent reviews.

Cap.Club is a professional software which was created with the goal to enhance cryptocurrency trading experience. It can be used both in the manual and automated mode round the clock without any restrictions. This bot can be used when you trade on Bittrex, Binance, and Poloniex by traders with a different experience.

Beginners would appreciate pre-made strategies and professional tutorials while experienced traders can customize a visual editor of the bot and use it to their benefit. Moreover, it is possible to start trading in a demo mode to enhance trading skills and only then proceed with a real account.

The software features a number of tools that help to make deals more profitable. It is enough to remember trading based mechanics for buying and selling, simultaneously working StopLoss and TakeProfit, strategy management by signals, several TakeProfit levels, the introduction of safety orders.

One of the greatest advantages of this software is to create multiple bots and use one which brings about more profit. If to combine this feature with high processing speeds which are less than 0.5 seconds, there are very high chances to get profitable trading experience.

Now, the number of traders who use this bot has almost 4000 people. You can use it for free with several restrictions or order a PRO account for $30 per month.

TradeSanta

TradeSanta is a cloud-based software designed to automate your cryptocurrency trading strategy and to make trading accessible to anyone. You can use this bot while trading on Binance, Bittrex, Bitfinex, and HitBTC.

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set.

Features

- Extra Orders

In case the price goes in the opposite direction to your expectations, the Santa trading bot places extra order to buy (or sell) more coins at the current price, making it possible to get desired take profit with a smaller price change in the future.

- Long and Short Strategies

You can launch automated trading bots with short and long strategy simultaneously. Whichever direction the price goes, TradeSanta cryptocurrency bots will cover it.

- Technical Indicators

TradeSanta technical indicators serve to ensure the crypto trading bot will enter the market at the optimal point.

- 24/7 Support

24/7 support is available by email or via Telegram anytime.

The platform was launched at the end of 2018 and is actively attracting new users. They already have more than 3000 users with nearly 13000 trading bots. TradeSanta has a powerful algorithm yet is easy to use according to the users’ feedback. So, both beginners and experts can get interested in it. And another good thing is that the platform is free for now.

BTC Robot

BTCRobot was one of the early innovations in the Bitcoin market.

The robot has proved easy to install as well as use. The company notes that its algorithmic trading does not predict markets perfectly, and there will always be losing and winning trades. Nonetheless, most have managed to make substantial profits.

It can be downloaded on the major operating systems but comes at varying prices for each platform. The license plans vary from $149 to $498 depending on requirements, which allows users to either download the program or use the cloud servers (with Mac downloads costing slightly more than Windows). The same time the BTC Robot features a trial period with a 60-day refund policy.

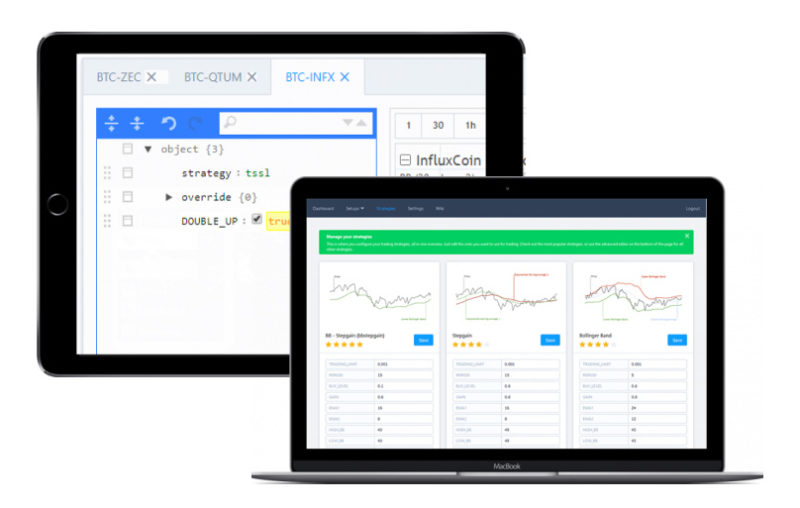

Haasbot

This program was created by HaasOnline back in the beginning of 2014. Haasbot is supported by many Bitcoin exchanges including Bitfinex, Poloniex, BTCC, Huobi, Kraken, Gemini and GDAX. It trades Bitcoin as well as over 500 altcoins on the various exchanges.

While it is designed to analyze the market information on your behalf, it requires some input to act upon regarding the trade execution. Haasbot is customizable and comes equipped with some technical indicator tools. With these tools, Haasbot can ‘predict’ trend patterns which can prove invaluable to Bitcoin trading success.

Although Haasbot is probably the most complete of the trading programs that are currently available, doing much of the labor with relatively minimal input required from the user, in order to provide this service, it is pretty expensive, with costs ranging from between 0.12 BTC and 0.32 BTC for a three-month period.

Zenbot

Zenbot is an open-source software for Bitcoin traders. As an open-source project, Zenbot is available for users to download and modify the code as necessary.

It is available on for use on all major operating systems and can be modified to fit every user’s preferences. Zenbot has been created using artificial intelligence, so it can exploit the arbitrage opportunities and execute the high-frequency trades. Additionally, the software can perform multiple cryptocurrency trades at the same time.

The bot is supported by Bitcoin exchanges like Kraken, Gemini, GDAX, Bittrex, Quadriga, and Poloniex. However, developers keep enhancing this software, so in future it will be supported by all exchanges available.

Zenbot supports multiple digital assets and uses a technical analysis-focused approach to execute strategies. It also offers high-frequency trade execution, extensive back testing, and a paper trading function to test strategies in real-time. Having said that, on Zenbots GitHub page its developer warns from using it with large amounts of trading capital as some users have reported losses in live trading even when paper trades showed gains.

Gekko

Gekko is an open-source bot and backtesting platform that supports 18 different Bitcoin exchanges. It allows users to execute basic cryptocurrency trading strategies. The bot aggregates live price data, calculates indicators, executes live orders, and can simulate live markets using historical price data for the backtesting of strategies.

Gekko also has a number of plugins available that will allow you to be updated regardless of what level of connectivity you have.

While its functionality is somewhat limited compared to some of its peers, Gekko is a good robot for those new to the cryptocurrency markets who want to test out different automated strategies.

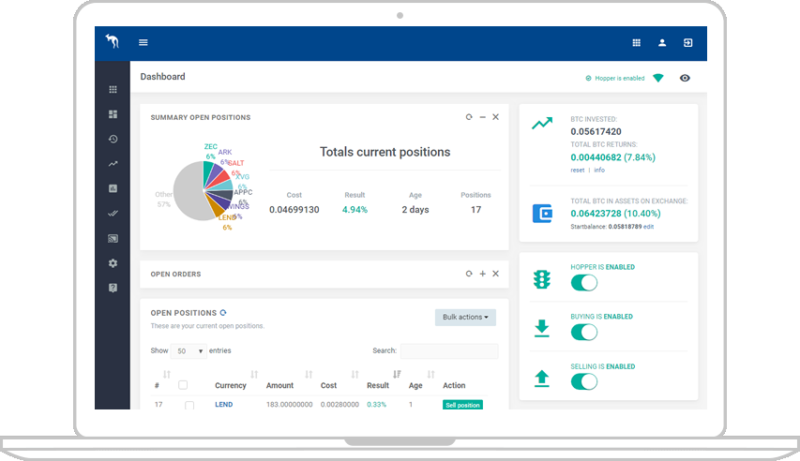

Cryptohopper

Cryptohopper is a cloud-based (24/7) cryptocurrency which means it can trade cryptocurrency 24 hours a day whether you are at your computer or not. Experienced traders can take a manual approach and configure trading based on multiple technical indicators. Cryptohopper also features embedded external signalers, which permit inexperienced traders to let their bot trade on autopilot, executing trades as recommended by trusted and performance ranked 3rd parties.

The robot also offers backtesting, trailing stop loss, and the ability to trade using multiple exchanges. The first months trading is free, with tiered subscription packages from $19 to $99 per month after that.

Cryptohopper has a very nice modern dashboard area where you can configure and monitor everything and comes with a config wizard or pre-created templates for the popular exchanges – Binance, Bittrex, Poloniex, GDAX and Kraken.

CryptoTrader

CryptoTrader is a cloud-based platform that provides users with fully automated trading solutions while not requiring them to install the software on their own system. It also allows users to develop their own cryptocurrency robots which are hosted on the platform. The software supports multiple currencies and exchanges, and allows for thorough backtesting of trading strategies. Additionally, CryptoTrader provides a marketplace where users can sell strategies they have developed as well as buy other user’s strategies.

CryptoTrader offers five different subscription plans, with fees ranging from 0.006 BTC to 0.087 BTC per month. The separate packages include a number of differences, including the number of robots operating on the user’s behalf as well as the maximum equity limit. Although though some knowledge of coding is beneficial when setting up strategies in the CryptoTrader bot, there are a number of free and paid strategies available for users that are not experienced/interested in coding.

The service also offers email and text notifications to alert users on important market events or changes in trends.

Gunbot

The Gunbot software features a wide range of settings and specifications designed for both beginners and advanced traders. The robot also uses individual strategies that are completely customizable to fit your trading style. It can be used across a range of major exchanges (Bittrex, Binance, Cryptopia, CEX.io, Cryptopia, Bitfinex, Kraken, Poloniex and Gdax) and is supported by a large user community. Prices range between 0.026 to 0.16 BTC depending on desired feature sets.

You can run the program on your own computer or use a VPS and can manually add different coin pairs, pick a strategy and set it to work.

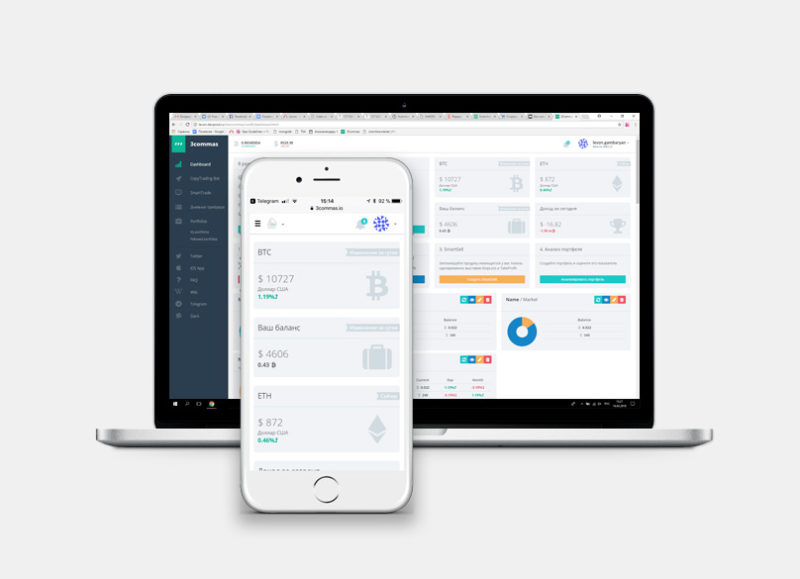

3Commas

3Commas is a popular bot which works with a number of exchanges including Bittrex, BitFinex, Binance, Bitstamp, KuCoin, Poloniex, GDAX, Cryptopia, Huobi and YOBIT. The robot works 24/7 with any device as it is a web-based service so you can monitor your trading dashboard on mobile as well as desktop and laptop computers. It allows you to set stop-loss and take-profit targets and also has a social trading aspect which allows you to copy the actions of its most successful traders.

Leonardo

This is a new program that is being supported by Huobi, OKCoin, Bitfinex, Bittrex, and Poloniex exchanges. And it should be supported by multiple other exchanges as well in the future.

Leonardo comes with two strategies including Margin Maker and Ping Pong. So far, Leonardo is the best-looking software regarding design and graphics. It also is fully customizable.

Initially, the robot cost about 0.5BTC every month. Now, however, it is available for about $129 (a lifetime license).

Summing up

Bitcoin trading robots can be an extremely useful tool for traders if used correctly. If you are able to regularly adjust the bot’s settings and define a trading strategy that works for you, then bots can become a phenomenal tool for trading digital coins.

However, be aware that some programs can easily turn out to be scams. Don’t forget to do research into a bot before starting using it.