Do you want to buy some Bitcoin? Should you just do it? Is now the right time to do it? Lets see if we can answer these questions.

Tom Lee is a Wall Street strategist and a co-founder of Fundstrat Global Advisors. He has created what he calls his Bitcoin Misery Index (BMI), which uses multiple market factors to calculate how miserable the holders of Bitcoin are, based on the current price level. This index might be very helpful when you are trying to decide when to make your Bitcoin purchase. Here, we tell you everything you always wanted to know about BMI, but were afraid to ask!

What is Bitcoin Misery Index?

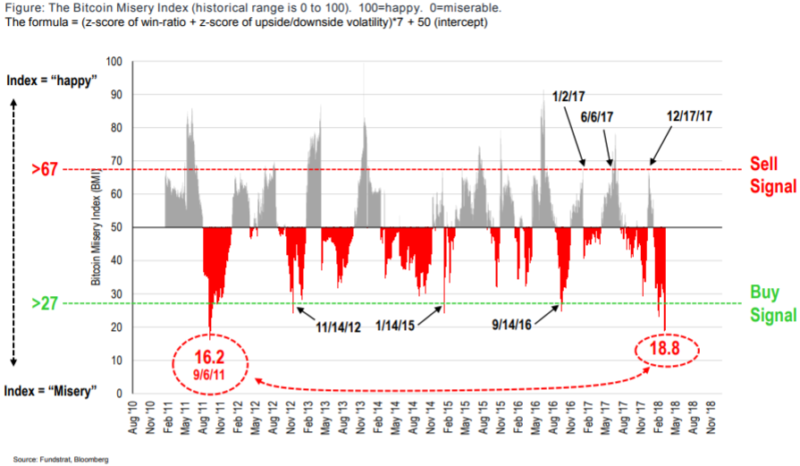

As the popularity and interest in Bitcoin grew, the threats to its stability grew likewise, leading to the formulation of the misery index. Regulatory and security uncertainty has given rise to a new type of misery index. BMI was designed as a trading tool for investors to take advantage of volatility in BTC exchanges. This concept was developed only in March 2018 and is getting popular every day. It is calculated on a scale of zero to 100, taking into account factors such as volatility and the number of winning trades out of the total.

The contrarian investment style, on which the BMI is based, focuses on buying assets when most other people are selling and selling them when demand is high and prices are growing. Similar to the Relative Strength Index (RSI) that is used for stocks, indices, and commodities, the BMI shows conditions of oversold and overbought.

How does the Bitcoin Misery Index Work?

The highly risky and speculative nature of bitcoin favors investors who are able to quickly analyze shifts in prices and understand the impact of news announcements, and place buy or sell trades accordingly. Seeing low index levels in BMI may prompt less sophisticated investors to automatically buy bitcoin, rather than consider the option to buy while also surveying other factors that may impact prices. It is possible that much of the increased demand for bitcoin since 2016 has been from less sophisticated investors.

The index is calculated by accounting for the number of winning trades from the total trades (percentage of days that Bitcoin is up), and also measures the volatility (upside less downside). When the indicator is low, the buying opportunity is at its best, and vice versa. Thomas Lee explained that “When the BMI is at a ‘misery’ level, future returns are very good.”

When the BMI is low it means that people are “miserable” and that basically falls below 27. At this point, people are “so miserable” that Bitcoin does quite well and it’s a good time to buy, according to Lee.

When the number is high, especially above 67, this means that people are getting euphoric and, as such, that is a signal to sell BTC based on a predicted decline.

According to the contrarian philosophy, when investors are unhappy, you should buy and when investors are happy, you should sell. Hence, the latest low of the index can be explained with the fact that the price of Bitcoin fell from an all-time-high of USD 19 666 in December 2017 to as low as USD 5920.72 in February 2018. This made investors doubt in the market and question themselves whether cryptocurrencies are just a bubble.

While indexes are useful as early warning indicators of market sentiment, they cannot predict the future. The Bitcoin Misery Index cannot predict whether there will be a theft at a cryptocurrency exchange. It won’t be able to estimate whether the Securities and Exchange Commission (SEC) will require crypto exchanges to register as legal exchanges, rather than just Internet-based platforms that allow bitcoins to be bought and sold.

Bitcoin Misery Index Websites

Unfortunately, the index does not seem to be publicly available on the internet. In order to get access to BMI, you will need to become a registered paying user of the Fundstrat Website.

Current BMI number

Since I am not a registered user of Fundstrat, I cannot share with you an up-to-date BMI chart. So just showing you and example of the most recent one found on the internet.

Conclusions

Keep in mind that BMI is a technical indicator and should not be taken with 100% certainty. All technical indicators are not free from fallibility.