Are you interested in altcoins? If so, then youll need to find an exchange where you can buy, sell, and trade them. Finding an exchange is pretty easy,

selecting the right one is the challenge! Take a look at our review of the 10 best exchanges for altcoins. Save this page! It might come in handy in the future!

Best Exchanges for Buying Altcoins

CEX.IO

CEX.IO is a global exchange that sells not only bitcoin, but Litecoin, Ether and a bunch of other coins. It is available in most countries via credit card and bank transfer, so it’s a great way to make your entry into cryptocurrency.

One of the best things about CEX.io is that the platform accepts a lot of different fiat currencies (USD, EUR, GBP). This makes it useful for people from many different countries.

Visa and Master card deposits charge a fee that is a percentage of the total transaction and a separate small payment. The fees for each currency are slightly different:

- USD – 3.5% + $0.25.

- EUR – 3.5% + 0.24 EUR.

- GBP – 3.5% + £0.20.

The same time, they will not charge you any commission for bank transfers and cryptocurrency deposits.

The site is certainly legit, as it has been registered in the United States as a Money Services Business. The agency that it’s licensed with is the Financial Crimes Enforcement Network (FinCEN).

The exchange also provides users with protection under a level two DSS certificate. This means it has proved itself as having a certain level of security to store, process, and transmit payment card data.

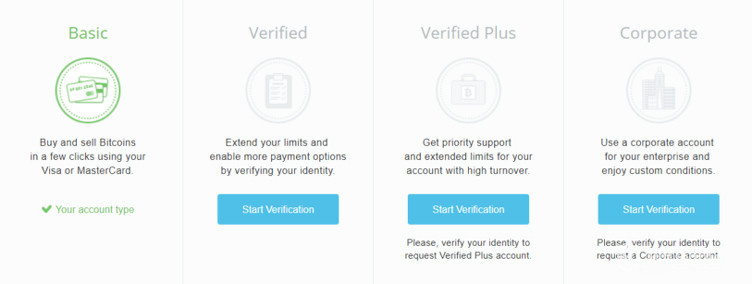

There are various levels of accounts on CEX.io. They are:

With its numerous deposit options, multiple digital assets, and user-friendly design, it’s obvious why CEX.io has been so successful.

Pros

- Supports USD, EUR, GBP.

- Offers mobile app.

- 2-factor account authentication (security features).

- Buy/sell/trade Ether, Litecoin, Ripple and a few other popular coins.

- Buy altcoins using credit or debit card.

- Great customer support.

- Trade exchange.

Cons

- Doesn’t have a very long list of cryptocurrencies.

- It has never been in the cryptocurrency top ten by market cap

- You won’t be able to use PayPal, Neteller, or Skrill at CEX.io.

Coinmama

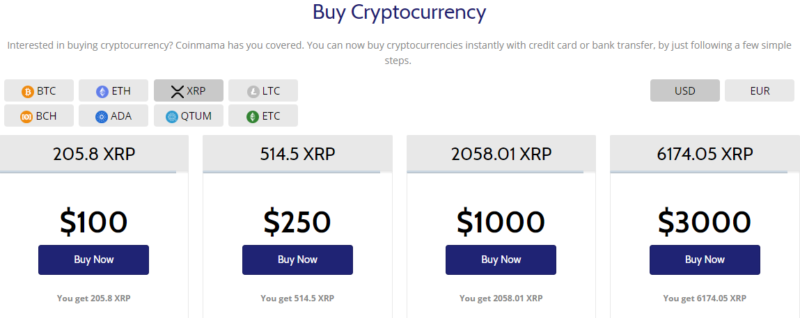

Coinmama aims to make it quick and easy for users to exchange their fiat currency for cryptocurrency. This popular marketplace allows users to buy:

To purchase altcoins using credit or debit cards, Coinmama doesn’t require users to register their credit or debit card in order to purchase cryptocurrency on the exchange. Instead, the procedure is that once users have registered (and regardless of whether or not they have verified their identity). They proceed to create the order by choosing how much they want to buy, entering their wallet address and then filling out their card details on the checkout page. Coinmama does not store customer’s credit or debit card details on their servers. After completing the payment, the transaction will then be processed by the credit card processor which will take just a few seconds before being transferable to the customer’s wallet of choice. Once the payment and wallet address are confirmed, the cryptocurrency is sent immediately to the user.

Coinmama supports most countries and has high buying limits, plus fast delivery time for coins. You should receive your coins within a few minutes of making payment.

The company charges a 5.9% transaction fee for each purchase. However, credit card and debit card transactions attract an additional 5% fee. It’s also worth checking with your bank or card issuer beforehand to find out whether you will also need to pay a cash advance fee for the transaction.

There are a few key factors that affect how long you’ll have to wait before you can access your funds:

- Time for bank or credit card processor to verify your payment

- Time required for you to confirm your digital wallet address

- Time for the blockchain to confirm each transaction

Once your payment has been approved and you have confirmed your wallet, Coinmama usually sends the coins within 10 minutes. You’ll then have to wait for the relevant blockchain to confirm the transaction, which may take another 10 minutes.

Coinmama offers high buying limits, especially in respect of credit card transactions. Verified users can purchase up to $5,000 per day, with a maximum limit of $30,000 per month. Daily limits last for 24 hours from the moment that the limit is reached, while monthly limits is a moving sum of the previous 30 days.

Customer support is available via email, as well as an extensive list of FAQ’s.

Pros

- Live pricing in US dollars and euros

- Makes it easy to buy crypto using your credit or debit card

- Buy direct from the site – no middleman

- Buy crypto in more than 180 countries worldwide

Cons

- Cannot sell cryptocurrency through Coinmama, only buy

- Does not accept PayPal, American Express or Discover

- High fees

- No mobile app

Indacoin

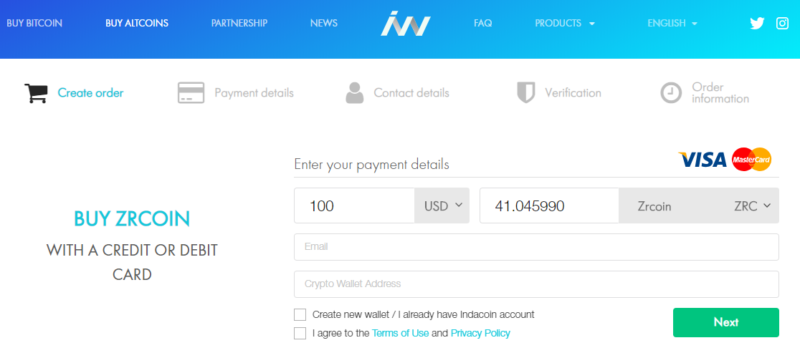

Indacoin is a cryptocurrency exchange that lets you buy 700 different tokens using a credit card. This provides a convenient entry point into the crypto world and makes it possible to purchase more obscure coins without having to first buy a major one, like Bitcoin or Ethereum. Indacoin does not require any registration to make a purchase.

Indacoin location in London means that it must adhere to regulations of the United Kingdom, providing additional peace of mind for users.

The exchange accepts only credit / debit cards (as long as they are 3d secure) or Payza. When you come to buy your Bitcoins you will first need to fill out a payment form and afterwards you’ll receive a phone call with a 4-digit pin code in order to complete the transaction.

You’ll pay a fee for each transaction you make on Indacoin’s trading platform.

- Market fee: 3%

The only option to withdraw fiat currency is through Payza.

- Percentage fee: 12% (US$2 minimum)

If you’re new to Indacoin, there are limits to how much you can spend on your initial transactions:

- US$50 for the first transaction, with a US$15 minimum.

- US$200 for the second transaction (four days after first purchase).

- US$500 after seven days from the first purchase.

For the first month, you’ll have a buy limit of US$5,000. After this, there is no limit.

In addition to buying cryptocurrency via Indacoin, you can also store more than 700 supported cryptocurrencies in a single wallet. Using the platform, you can easily send crypto to others with the same ease that you would send a message. You can also view your investment portfolio and track changes within it.

Indacoin offers a mobile application for both Android and Apple users, making it possible to take advantage of the wallet and other features via your smartphone or tablet.

Pros

- Fiat Purchases

- Good Choice of Coins

- Well Established

- Trustworthy Company

Cons

- Very High Fees

- Poor Trading Interface

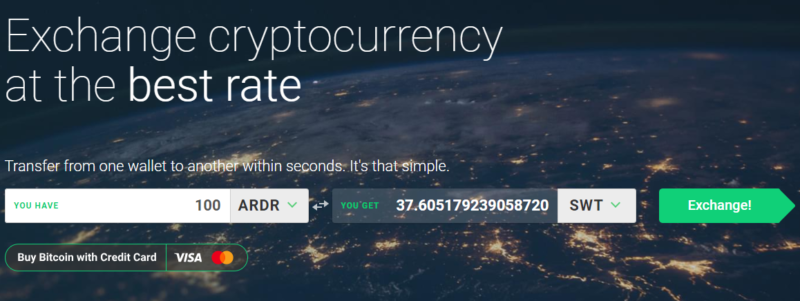

Changelly

Changelly is a cryptocurrency exchange based in Prague and been in operation since 2015. It uses an automatic trading robot that integrates with some of the largest trading platforms, including Poloniex and Bittrex. It operates by making bids and asks on respective exchanges to suggest the best available rates on trading pairs. Basically, Changelly allows you to purchase dozens of popular digital currencies without registering at any exchange or needing verification.

The platform accepts payments in nearly any cryptocurrency (as well as credit card or debit card) and you can receive payout in any other coin.

Here you will find familiar and extremely popular cryptocurrencies, such as Bitcoin, Litecoin, Dash, Ethereum, Dogecoin, and Monero, along with some you may not have heard of, including XDN, BCN, FCN, NBT, NXT, FCT, and RADS. Thanks to the large listing, it is very likely that Changelly supports the crypto you want to change between. There is also a form available where you can suggest adding your token to Changelly platform.

The fees are as follows:

- 0.5% Commission on Crypto to Crypto Trades.

- 5% Changelly Commission and 5% Simplex Processing Fee on Credit / Debit Card Purchases.

Those paying with bank cards will have limits for their first few transactions. Cards from the U.S., Canada, or Australia will have a $50 USD limit on their first transaction. The following purchase can be made in four days with a $100 limit. After seven days from the first buy, the limit is up to $500. You cannot make more than three payments in the first week but have no monthly payment limits.

On average, a Changelly transaction will process within five to 30 minutes. There are some reasons that they may take longer, including a blockchain overload.

Pros

- Easy for Beginners

- Lots of Cryptocurrencies

- Secure System

- Fiat Purchases

- Easy and convenient way to switch between altcoins

- No personal information required to use

Cons

- High Fees for Fiat Purchases

- Customer Support can be Slow

- Speed dependent on Blockchain

Best Exchanges for Trading Altcoins

Binance

Binance is a Chinese exchange recently relocated to Malta. It is focused on crypto-to-crypto trading and gained its popularity in the blockchain community thanks to its impressive coin offerings and low trading fees.

There are two options for trading platforms on Binance: Basic and Advanced:

- Basic view is nicely designed and well laid out, all the information you need is clearly presented with prices on the left, graphs in the center along with the buy and sell boxes and the trade history is presented on the right so you can quickly see what the latest trade prices were.

- Advanced view uses a dark theme and makes the trading charts larger and the latest trade prices are displayed on the right with the buy sell boxes underneath.

Binance currently charges a flat 0.1% fee on each trade. For an exchange that doesn’t use a fee schedule, this is one of the lowest fees I’ve seen.

If you pay using their own token (BNB), you currently receive a 50% discount on the trading fee – bringing it down to 0.05%. With this discount, Binance easily has the lowest fees in the industry.

Some of the available coins are:

- Ark

- Bitcoin

- Bitcoin Cash

- Bitcoin Gold

- Dash

- EOS

- Ethereum

- Ethereum Classic

- IOTA

- Litecoin

- Neo

- OmiseGo

- +36 more coins

Many investors like Binance because they offer coins that often aren’t listed on other exchanges such as Bitcoin Gold, IOTA, and Walton Coin.

Many of the coins traded on Binance are ERC20 tokens. Binance fully supports deposits and withdrawals for all of these tokens.

Binance is strictly a cryptocurrency exchange, so you’re not able to fund your account with fiat currency. You can only deposit cryptocurrency funds, but there’s no limit on the amount that you can deposit. There are also no fees on any of your deposits.

PROS

- Low fees for trading a large number of cryptocurrencies

- Frequently adds new coins and trading pairs

- Highest volume exchange, so good liquidity

- iOS app

CONS

- Customer support has slow response times

- Website can be not easy

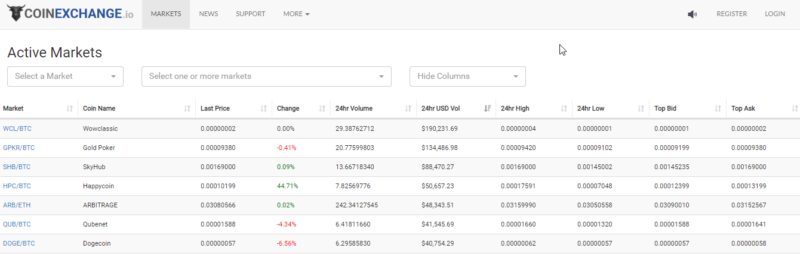

CoinExchange

CoinExchange is a crypto-to-crypto platform which specializes in altcoins. There are more than 400 different crypto pairings available on the platform, which is quite a lot.

When a new cryptocurrency project is launched, the project will list its coin or token on CoinExchange so that people can invest.

The platform charges a fixed amount of 0.15% for both buying and selling coins. Although this isn’t the cheapest in the industry, it is much lower than many other cryptocurrency exchanges.

It is ideal for beginners, making it unlikely that you will make any mistakes. Furthermore, the exchange uses very little colors, making it easy on the eye!

Many of the larger cryptocurrency exchanges will ask you to submit ID before you can trade, such as a passport or driving license. This is not a requirement at CoinExchange, which means you can buy, sell and trade coins anonymously.

CoinExchange have a high minimum deposit on some of their coins. For example, if you wanted to deposit Ethereum (ETH), you would need to deposit a minimum of 0.1 ETH

Pros

- Low fees

- Free Deposits

- Simple interface

- Numerous coins

- Anonymous trading

Cons

- No information about the company

- Customer support is poor

- No Fiat Currency Deposits

HitBTC

HitBTC is a crypto currency exchange owned by HIT solutions Ltd, which is based in Hong Kong. It is a highly advanced exchange for a variety of Altcoins including DASH, ZEC, EOS and BTS. Their core-matching engine includes superior order matching algorithms and real-time clearing.

They also have positive reviews for their high availability, uptime, and fault tolerance.

Key Features:

- Rebate system – attractive to the most powerful market makers, creating high liquidity

- No limits for deposit or withdrawal of digital assets

- Cutting-edge matching engine technologies

- Wide range of available instruments (more than 500)

- The most advanced API on the market (REST API and FIX API)

HitBTC uses a ‘Maker-taker’ model to maximize liquidity while narrowing the spread on their markets. When you place a market or stop order that is immediately filled, you are a “taker,” and you pay a “taker” fee for this.

This is because you are “taking” the price you want right now (removing the liquidity from the books) by buying or selling limit orders sitting on the books.

When you place an order that doesn’t fill immediately (like a limit order), you are a “maker,” who is providing liquidity to the order book, and you pay a reduced “maker” fee for this.

On HitBTC, “Takers” are charged with a 0.1% fee from the trade. “Makers” are not charged with a fee, and instead receive a 0.01% rebate from the trade.

While verification is not mandatory on HitBTC, unverified accounts do have certain withdrawal limits in a day. Hence, if you wanted to withdraw more than the limit that they have on the exchange then you will have to verify your account.

Making deposits on HitBTC is quite simple, the site integrates Changelly, which allows you to purchase Bitcoin directly with your credit card. You can then send your purchased Bitcoin to the specific address listed on HitBTC exchange.

PROS

- Range of Markets

- Well-Designed Interface

- Reasonable Fees

- Well Established

- High volume and liquidity

CONS

- Poor Customer Support

- Verification Can Be Slow

- No Fiat Payment Options

- Bots Trading on the Exchange

- Slow Withdrawals

Best Exchanges for New of Small Altcoins

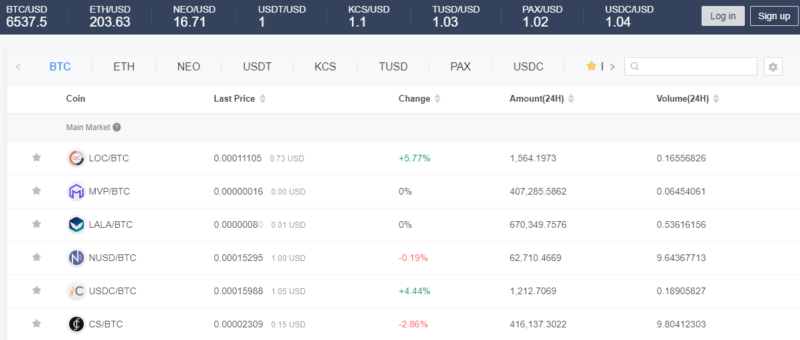

KuCoin

KuCoin exchange is a relative newcomer to the cryptocurrency exchange scene, but it already has a massive following. It was launched in 2017 with the goal of making it one of the top 10 exchange platforms by 2019. The plan is simple: focus on attracting new customers, provide an easy to use interface, and reward users for trading.

KuCoin have more than 340 different trading pairs available. They support more than 75 individual cryptocurrencies and they are adding to this list all the time.

Within this list includes the majority of popular coins, such as Bitcoin, Ethereum, Litecoin and Bitcoin Cash, as well as less popular (but still top cryptos) coins such as VeChain and Lympo. The easiest way to get a complete up-to-date list of what cryptocurrencies you can trade at Kucoin is to click here.

Kucoin uses an underlying technology that supports an infinite number of cryptocurrency trading pairs. The initial list includes ETH, BTC, and USDT markets, including trading pairs with various ERC20 tokens, NEO, KCS, and LTC. This will quickly expand, there will also be a unique feature that allows cryptocurrency managers or regular people to register their own cryptocurrency pairs and begin trading. New currencies are constantly added, with QLink, LAToken, and UTRUST all being listed on Dec. 29, 2017, and TFL being listed the day before. Kucoin has already developed a reputation for offering coin pairs earlier than other exchanges, helping it secure a market share.

Customer support for Kucoin is very good, with multiple methods of contacting the support team. Support is available 24/7, and team members pride themselves on resolving any issues in a timely manner.

PROS

- Transparent & Reasonable Fees

- Good Support

- Easy to Use

- Lots of Early-Stage Listings

- Highly Regarded

CONS

- No Fiat Payment Options

- No Margin Trading

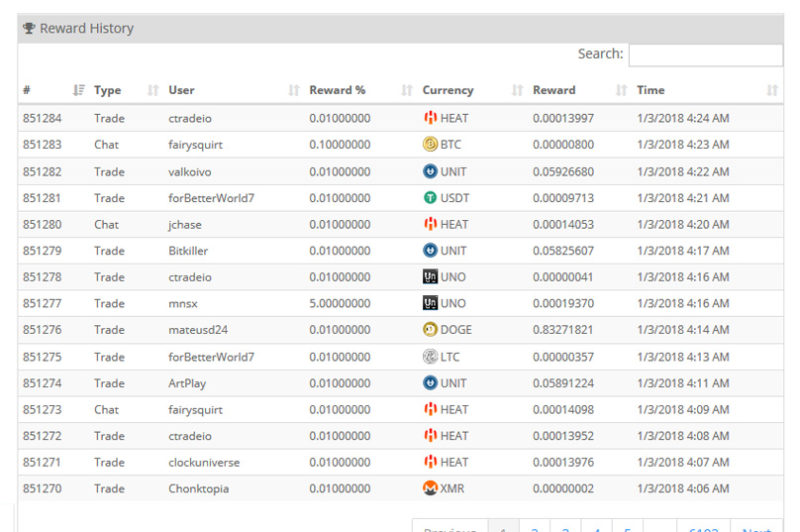

Cryptopia

Cryptopia is a combined peer-to-peer cryptocurrency exchange, trading platform and marketplace run out of New Zealand. It’s designed to facilitate the buying, selling and trading of almost anything, using cryptocurrency.

One of the main benefits might be the ability to transfer bitcoin and other currencies between users free of charge, as it’s being passed through Cryptopia rather than along the blockchain. It also offers a range of features that you might find useful, including:

- Marketplace: The listings marketplace for buying and selling with cryptocurrencies.

- Arbitrage: An information section where you can see the prices of coins listed on other exchanges. This can help you pick out the better value for money listings and make more informed decisions.

- Coin info: Up to date information on over 500 of the altcoins being traded at Cryptopia.

- Paytopia: Cryptopia’s own products and services, including various promotional tools to use with your listings, available on per-month subscriptions and payable with Dotcoin.

As long as you verify your account, you can use Cryptopia regardless of where in the world you are. Just keep in mind that the only fiat currency the platform uses is New Zealand dollars since this is where the platform is based. Additionally, any bank transfer must be done using a New Zealand bank account. This means that as long as you are willing to stick to cryptocurrencies or convert your fiat currencies into New Zealand dollars, you can use Cryptopia.

Cryptopia has a reward bot that rewards users when they use the website and complete certain actions. The rewards all have random amounts of random coins and are awarded for completing random tasks within a specific time window. Just some of the actions that can lead to rewards include finding blocks, voting, chatting, inserting mining shares, trading, and tipping. The full reward history is listed on the website for transparency.

There are two kinds of fees you’ll run into. These include:

- Exchange. There are fees for transferring cryptocurrencies from one wallet to another. The fees depend on the currencies being transferred and other factors.

- Withdrawal. Transfer fees apply when withdrawing NZD from your account, as well as cryptocurrencies. When withdrawing cryptocurrencies, you’re essentially transferring them from the Cryptopia wallet to your own, so it’s also a transaction fee.

PROS

- Lots of Listings

- Good User Community

- Low Fees

- Marketplace

- Good for Beginners

CONS

- Slow Customer Support

- Dated Interface

- Fiat only for New Zealand

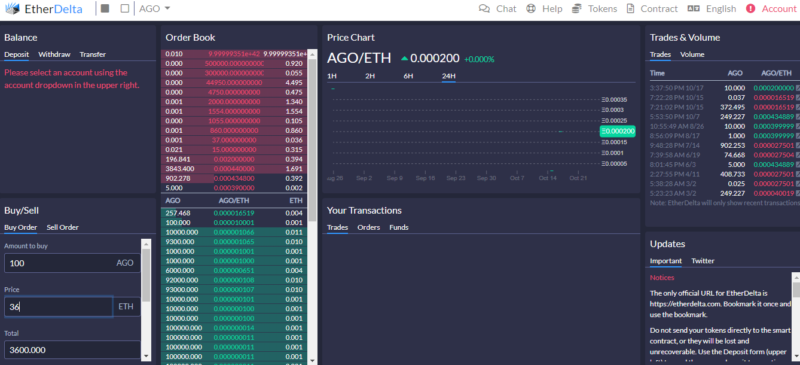

EtherDelta

EtherDelta is a decentralized Ethereum token exchange. Here, users can trade most Ethereum-based tokens such as Iconomi, Augur, 1ST, and others. The exchange only has one fee, which is the 0.3% taker fee. Deposit, withdraw, and maker transactions are all free.

One of the site’s most distinguishing features is its use of smart contracts, users do not need to open an account on the site as functions such as deposits, trades, and withdrawals, are performed via smart contracts that only require a user to integrate a wallet on the site.

EtherDelta is more decentralized than other mainstream exchanges and the site also uses a compact interface that takes some getting used to. The front page contains all the relevant features including the wallet, order book, and price chart and users do not need to navigate to any other pages in order to complete their trades.

Placing orders on EtherDelta is actually free as the action doesn’t involve an Ethereum transaction, the only platform fee EtherDelta charges is a 0.3% fee paid by the person executing an order.

Pros

- A decentralized exchange

- A wide range of tokens

- Provides quick access to new ERC-20 tokens

Cons

- A Non-intuitive trading process

- Limited by the Ethereum network

- Slow trades and transfers

- Run by a mysterious new management team

Conclusions

It can be really difficult to pick the best cryptocurrency exchange for altcoins as they all have their own advantages and disadvantages. Sometimes it might be a wise decision to use several platforms to meet all your demands.