It is unlikely that exchanges submit trading information to the American Internal Revenue Service (IRS). Binance, along with other big exchanges, usually honour the safety and independence of their international users. That said, everyone should be a law-abiding citizen of their own country, and follow its tax laws and regulations. Here, we tell you how Binance interacts with the IRS.

Cryptocurrency Taxation

The Internal Revenue Service (IRS) says virtual currency transactions are taxable by law. The agency issued its first and only guidance on how tax principles apply to transactions using cryptocurrency in 2014.

According to this guidance, for tax purposes, cryptocurrencies (convertible virtual currency) should be treated as property, not currency. Which means it has an equivalent value in real currency or acts as a substitute for real currency. Not all cryptocurrencies act this way, but most of the major ones, like bitcoin, do.

Basically, if you bought bitcoin and havent sold, you havent realized any gain. You probably dont have any reporting obligations.

But if you sold bitcoin — or any other cryptocurrency — in the last year, youll need to report the gains and losses.

Since IRS determines cryptocurrencies to be property, like stocks or real estate, youll need to pay taxes if youve realized a capital gain and you can lower your tax bill if youve taken a loss.

Youll need to gather the following information:

- when you bought the crypto

- how much you paid for it

- when you sold it

- what you received for it.

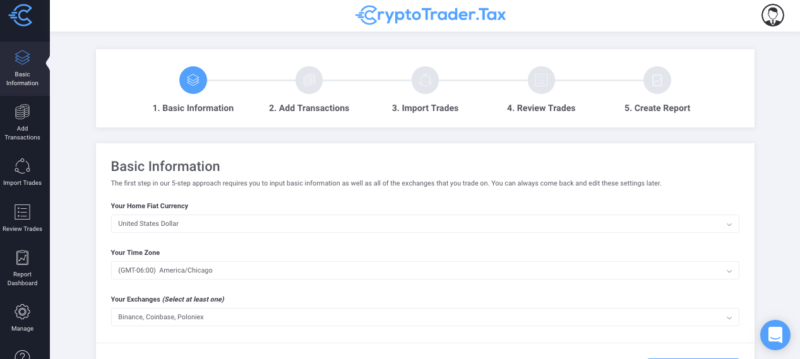

Alternatively, you could use websites aimed at helping bitcoin investors determine their tax liabilities. CryptoTrader.Tax, Bitcoin.tax and Cointracking.info will help you figure out your transaction history, how much you owe and how to fill out the 1040 form for reporting capital gains or losses.

Non-US Exchanges

It may occur to you that if no one is reporting your capital gains to the IRS, no one really knows about your investments. E.g. you are trading on Binance, which is an offshore site and your account is worth at least $10,000, you are required to disclose your account value to the United States Treasury under FBAR (Foreign Bank Account Reporting) guidance on a FinCEN (Financial Crimes Enforcement Network) Form 114, if you meet the filing thresholds. Failure to do so can result in serious monetary penalties and/or criminal proceedings, or both (penalties ranging from $250,000 to $500,000 or 5 to 10 years of prison time or both.)

Keep in mind that while the digital wallets (like Myetherwallet) are not covered under the definition of Foreign Financial account – crypto exchanges located outside the US still falls into the definition of Foreign Financial account and is subjected to FinCEN Form 114 rules. It means that you will need to include your Binance taxes.

In determining whether you have FinCEN Form 114 filing requirement or not, you have to consider the aggregate value of ALL non-US accounts together. Even if you have minimal amounts in most accounts, once you cross the $10,000, you will have to report ALL of your non-US accounts. Remember, what you are looking for is NOT balance as of December 31st, rather, highest balance during the year, even for a day counts.

How to file Binance IRS?

Remember that even if the IRS gets the trade data from Binance or Bitrex or any other exchange, they still have to match it to a taxpayer. Unless you put your SSN into these systems, the IRS is still missing this key piece of info.

With that said, we would still recommend reporting every transaction. Better to be safe than sorry.

- Create an account on one of the platforms that will help you determine your tax liabilities.

- For Binance tax reporting, upload all of your transactions (CSV file of your complete trading history) from the Binance exchange and any other that you traded on. You might need to generate multiple reports as Binance only allows you to export history for 3 months at a time.

- After uploading all of your transactions into the platform, review and generate your reports.

- After you have the reports, you can either fill in tax forms (e.g. 1099 form) on your own or send them to your tax account assistant.

Summary

As you understand, nobody can guarantee 100% if Binance reports any information to IRS, however, it is hardly possible according to multiple discussion on different forums. Nevertheless, to sleep safe and sound, it is recommended to follow the tax legislation provided by your country of residence.