Due to the increasing acceptance of Bitcoin and other cryptocurrencies, many businesses have started payment services that earn fees, by allowing customers to pay using cryptos. Thanks to Bitcoin payment services, you can pay for your coffee at the coffee shop by scanning the shop’s QR code on your mobile phone or purchase a high-end laptop from a corporation like Dell by paying in BTC.

Cryptocurrencies allow for the transfer of coins between individuals on a decentralized peer-to-peer network, which cuts out the middlemen typically involved in these transactions.

One of the benefits of cryptocurrencies is that transactions can occur in cyberspace, with no fiat currency having to change hands. These transactions are a lot less expensive than using a typical bank, which charges a lot in fees. This is one of its most attractive features. The value of a cryptocurrency, when it is exchanged for a fiat currency, depends on the current market price, just like any Forex market.

Now, more and more, you can use cryptocurrency in nearly every facet of your life, and pay for goods and services: buy coffee, order pizza delivery, or even pay your credit card with BTC. Here, we take a look at the 9 best Bitcoin payment processors for merchants.

What is a Bitcoin Payment Service?

As a digital currency, BTC can and should be used for its intended purpose – to facilitate the transfer of payment for goods and services. The more merchants that accept the digital currency as a pay form, the quicker cryptocurrencies will take root.

Nowadays, a growing number of businesses are accepting digital currencies, as the available options for payments increase in number and function.

Bitcoin merchant services work similar to the processing of a standard credit or debit card reimbursement service, with some specifics to Bitcoins. They enable sellers and businesses to receive payments in BTC from individuals for the goods and services being sold or delivered.

When you use your credit card to pay for your groceries at the supermarket, buy a new book on Amazon, or pay your credit card bill with digital currency, a payment service system works behind the scenes to enable authentication and processing of your credit card for making the discharge.

A similar workflow happens with the Bitcoin credit card processing. Cryptocurrency payment services act as an intermediary between the payer and receiver for processing the payment that also involves recording the transaction on the blockchain public ledger.

They allow sellers to accept crypto transactions both online and at physical locations without the buyer or the seller worrying about the complex background process of Bitcoin payments that gets executed in the background.

These days, most of these processors facilitate the buying and selling of many other altcoins such as Ethereum, Litecoin, Ripple, and Bitcoin Cash too.

However, the cryptocurrency market is incredibly volatile. The price of BTC fell 45% in December 2017, from $20,000 down to just below $11,000. This kind of volatility means that business enterprises of all sizes need to ensure that any amount received in BTC are quickly converted into fiat currency to avoid any potential losses.

Payment processors facilitate the immediate transfer of cryptocurrency into fiat currency. They allow merchants to automate these payments and provide a host of other tools and reports to help make the whole process as convenient as possible.

How to Receive Bitcoin Payments?

All popular payment services provide you with multiple options on how to accept Bitcoin: solutions for various platforms, like integration with e-commerce platforms (Shopify, PrestaShop, and Magento), through in-store point-of-sale (POS) systems, like Soft Touch and DC POS, and for direct transfers from within the popular billing and accounting solutions, like Host Bill and Invoice Ninja. After signing up for Bitcoin merchant services, you can start receiving crypto payments from customers from across the globe.

Workflow

Your customer wants to make a Bitcoin transaction at the checkout and pays the amount at the locked-in exchange rate applicable at that moment. You receive the coins to your BTC merchant account. After that, the Bitcoin payment service instantly converts the received coins into the currency of your choice eliminating the volatility risk (at this step you can also transfer the coins to your own BTC wallet instead of exchanging them for fiat currencies). The money gets added to your account, and it finally gets credited to your designated bank account at the decided frequency once the accumulated account crosses the threshold limit.

The service also sends the necessary details in a secure manner to the blockchain network for the transaction to be authenticated and recorded on the public ledger.

Miners, who verify and add the transactions to the blockchain, receive a miner fee. This fee does not go to the payment service but is given to reward the miners for their work done for verification and authentication.

Advantages and Disadvantages

Bitcoin is a faster and cheaper monetary exchange for providers of any services or goods. Whether online or at a physical location, using cryptocurrency has significant benefits compared to credit card services and other methods.

Digital currency for B2B payments, especially for international ones, is becoming more and more commonplace. The advantages, however, are also there for B2C e-commerce businesses.

Advantages:

- The fees are much lower than those of traditional payment mechanisms and are paid by the purchaser,

- Quickly settled (transaction confirmation usually occurs within 10 minutes or less),

- No possibility of chargeback as BTC transactions are final and confirmed on the blockchain (which gives merchants the final word on returns and fraudulent activity),

- Invoices and easy to use Point-Of-Sale (POS) applications for smartphones or tablets,

- Instantly convert the BTC amount to your local currency,

- Businesses that have an international customer base can implement Bitcoin payment methods and never again have to be concerned with currency exchanges and the fees involved,

- The application of blockchain technology in payments makes them more secure. It is also much safer to store coins rather than large amounts of currencies. Blockchain technology has lots of computing power that secures Bitcoin storage,

- Millennials, fast becoming the largest consumer market, are embracing Bitcoin and blockchain payment solutions as more trustworthy and efficient than traditional ones,

- Offer existing customers new ways of paying,

- Gain access to new customers who prefer using cryptocurrencies to pay for goods and services,

- Allow customers a discreet payment method (no embarrassing credit card statements),

- Secure and are retained indefinitely on the blockchain ledger.

Disadvantages

- Workers need to be educated on Bitcoin so that they can help customers. (If your staff doesn’t understand digital currencies, how will they help customers understand and use BTC for transactions?),

- Cryptocurrency is volatile (its price bounces every day mainly due to current events that are related to digital currencies),

- Bitcoin is fairly new, and there are problems related to its newness. These problems need to be resolved.

Best Bitcoin Merchant Services

Payment Gateways

Coinbase

Coinbase Commerce is the easiest and safest way for your business to start accepting digital currency payments. Designed and built by Coinbase, the world’s leading digital currency company. Run your business from anywhere in the world and get access to a global customer base by accepting the borderless digital currency.

The company provides an HTML widget for easily inserting payment buttons into your website, and plugins for WordPress, WooCommerce, Magento, and ZenCart. However, it currently only supports U.S. bank accounts as a funding source. Notable merchants using Coinbase are Dell and Expedia.

It also seamlessly integrates with Shopify to make accepting cryptocurrency easier than ever.

Simply connect your Coinbase Commerce account to start accepting cryptocurrency as your payment option.

An added value is that there are no transaction fees if you keep the funds in BTC. 1% transaction fee for converting BTC to your local account currency, yet only after $1,000,000 in sales.

Key Features:

- Highly customizable checkout experience.

- Mobile-friendly design.

- You can select among embedded widgets, plugins, or build a custom integration with their API.

- Two-click payments for Coinbase wallet holders.

- Instant exchange is available for payouts.

- Supports invoicing via email.

- Supports microtransactions in BTC.

BitPay

BitPay’s goal is to make it easy for businesses to accept BTC. They are the largest BTC payment processor in the world, serving industry-leading merchants on six continents. They’ve created a seamless, secure Bitcoin payment experience used daily by hundreds of thousands of cryptocurrency users.

Use BitPay’s retail, e-commerce, billing, and donation tools to accept transactions from customers anywhere in the world. You can receive a settlement for BTC and BCH directly to your bank account in your own currency, with zero price volatility or risk.

No transaction fees for 30 days. Capped at $1,000 daily and $10,000 annually. And 1% for transactions going above the cap.

Key Features:

- Set custom transaction speed depending on your preferences.

- Two-factor authentication for accounts.

- Invoicing supported in 40+ languages with calculated pricing displayed on invoices in 150 currencies.

- Bank payouts in Euro, USD, GBP, and five other currencies.

- Supports payment protocol (BIP 70 and BIP 73), which creates an additional level of security.

- Hassle-free Bitcoin refunds.

- Ledger payment tracking available.

GoUrl

Gourl.io is a global provider of online cryptocurrency payment solutions. Gourl.io is a platform where vendors and consumers can transact with each other, backed by the Bitcoin and altcoin protocols. GoURL.io has over 18,000+ registered companies and vendors from all over the world.

WordPress has rated GoUrl as one of its top Bitcoin plugins. Nice features include integration with all website pages and no navigation to external payment pages. Other features are pretty standard, such as receipt of coins directly into the merchant’s wallet with conversion to USD/Euros/other currencies at any time after that. Conversion is not automatic, however, so the rate will depend on the exact time of conversion.

You pay 1.5% in fees to accept transactions on websites and 3.5% if you are using Monetiser Online.

Key Features:

- No ID or bank account needed to start accepting crypto. The platform is highly anonymous.

- With Monetiser Online you can create a payment URL in one click and receive digital currency without installing any integrations.

- Works with all popular wallets.

- Offers detailed payment statistics.

- Compatible with bitcoin debit cards for payouts.

- All the money is forwarded to the merchant’s wallet within 30 minutes. The processor does not store customer’s funds.

- Transaction processing takes just 5 seconds.

Lamium.io

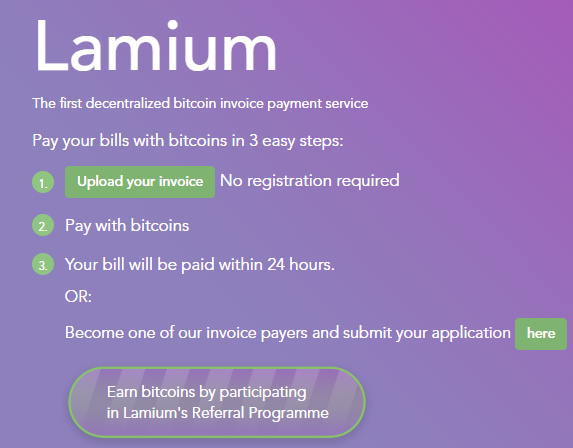

Lamium.io is the first decentralized bitcoin invoice payment service owned by CoinNexus, a Finnish Bitcoin startup that aims to provide less centralized services for greater integration of blockchain based financial solutions for daily life challenges.

The company believes that eliminating the need for central authorities and banks from invoices with Bitcoin will create more efficient and vivid Bitcoin community.

The platform uses secure user-side encrypted multi-signature wallets for their escrow purposes that eliminate the possibility of malicious actors stealing the funds involved.

If you are a CoinNexus user, you can invoice your clients and customers in Euro (EUR), US Dollar (USD) or Swiss Francs (CHF) while you receive Bitcoins for yourself. You are no longer required to own a bank account to receive payments. Your clients will make a payment to CoinNexus bank account and you will get Bitcoins to your Lamium account.

Lamium.io has also set up a referral program that allows you to earn bitcoin. Every time you refer an invoice to their database you will each receive a 0.5% commission of the value of the referred invoice after the invoice has been paid in full. Payout of referral bonus will be done upon request via the connected Lamium wallet once you have reached a minimum payout amount of 20 EUR.

Fees & Charges:

| Invoice Service | 1.97% of the invoice sum plus a fixed amount of 0.0001 BTC per invoice.

|

| Buy Bitcoins | 2% of the paid out amount plus a fixed rate of 0.0001 BTC per purchase |

| Sell Bitcoins | 2% of the sold amount. |

| CoinNexus payout | 2% plus the bitcoin network fee for the clearance payment |

| Sell Bitcoins | 2% of the sold amount. |

Key Features:

- Decentralized invoice payment

- You don’t need to have a bank account to invoice your clients

- Encrypted Lamium wallet

- Referral program

AlfaCoins

AlfaCoins has the unique feature of offering payments to be split between fiat and cryptocurrency. For those merchants who wish to retain some amount of BTC from each transaction to cash in on surging prices, this is a great option, as it allows them to hedge their bets without risking the entire amount.

While AlfaCoins has a slightly lower transaction fee of 0.99%, it doesn’t offer the $1 million worth of free transactions that Coinbase does. However, AlfaCoins does not charge additional fees for their payment gateway and is subscription-free. A further bonus is that AlfaCoins can be used in any country with the exception of Iran and North Korea. It allows funds to be withdrawn in USD or Euros.

Key Features:

- Mature payment processor with extensive API documentation.

- No fees for the module, or for the subscription.

- A payout system to handle mass payments (e.g. salaries/bonuses).

- Allows splitting incoming transactions into two portions – cryptocurrencies (BTC, LTC, ETH) and fiat.

- Bitcoin can be withdrawn to a bank account in Euro or USD from all countries except North Korea and Iran.

Shopify

Shopify is one of the world’s most trusted Bitcoin payment gateways. As a result, it is already being used by 1,000’s of merchants throughout the world.

It is really easy to set up and has plenty of customer service support should you need any help. The platform is crammed with loads of good features, including APIs that allow integrations with Coinbase and other payment gateways that help make transaction processing as easy and transparent as possible.

Transaction fees vary depending on the Bitcoin payment processor you choose.

Key Features:

- Easy to set up, with extensive documentation available.

- PCI compliant solution.

- Supports Bitcoin transactions through POS applications.

- Shopify platforms come with a lot of extra tools to set up and run an e-commerce store.

Point of Sale

Blockchain

Blockchain Merchant is the free point-of-sale app for Android that makes it easy for your growing business to instantly accept Bitcoin at any retail location. It’s the ideal app for restaurants, bars, cafés, and all retail merchants accepting cryptocurrency. Just set up the Blockchain Merchant app with your cryptocurrency wallet address and your business can start receiving BTC immediately.

There are a lot of languages to choose from, including English, French, simplified Chinese, Arabic, Italian, Portuguese, Spanish, Russian, and Japanese.

They also support many currencies, including USD, ISK, HKD, TWD, CHF, EUR, DKK, CLP, CAD, CNY, THB, AUD, SGD, KRW, JPY, PLN, GBP, SEK, NZD, BRL, RUB.

Coingate

Point of Sale apps for Android and iOS allow Businesses to accept BTC transactions on a mobile device. POS web app can be accessed from any internet-enabled device directly in a web browser. Sell on outdoor locations or when on the move without impacting speed or performance. New orders can be created and processed within seconds in a few steps without any interruptions or delays. Track orders in your Merchant account online or on your Bitcoin POS app directly. The application works as a virtual terminal and usability is simple, highly intuitive and quick for new staff to learn.

XBTerminal

XBT Mobile allows you to start accepting BTC with no upfront costs. Customers may pay from any mobile wallet by NFC (Android only) or QR code. Payment from offline mobile devices is supported by Bluetooth (Android only). The whole process is fast and secure. This solution best suits merchants without a fixed point of sales like a pop-up or street traders.

BitcoinPay

BitcoinPay is integrated into professional Point of Sale App LILKA. It supports tablets and smartphones. LILKA registers sales and provides complete sales overview needed for accounting. LILKA allows transactions in cash, BTC, and can be connected to a credit card reader.

Summary

As a merchant, you cannot underestimate the importance of offering a good range of different payment options. Accepting cryptocurrency will give merchants access to new customers and help to boost profits. It is a win-win situation that no merchant should ignore. Of course, you should not forget to pay taxes.

And if you are accepting BTC, you need to publicize that fact with a sign. You can, of course, make your own, or grab the ‘Bitcoin accepted here’ sign from the bitcoin wiki.