OK, so you’ve learned about digital currency. You might be thinking about becoming a crypto miner, and joining a mining pool. It might even seem like its California in 1849 again (you remember the California Gold Rush, dont you?), when everyone wanted to become rich. Only now, instead of wagon trains, we have the internet. Instead of tin pans, we have computers. And, instead of gold, we have digital gold Bitcoin, and other altcoins.

All you need to mine cryptocurrency is a computer, the internet, and a special piece of software. You’ll find this software at the GitHub repository of the cryptocurrency you have chosen to mine. Alternatively, it might be built in to a cryptocurrency’s wallet software. This is the case with coins such as Monero and Electroneum.

But first, you need to decide on your goal for mining:

- Business with immediate profit

- A hobby that just might make you rich some day

- Help to secure a network (e.g. some people, called Bitcoin hobbyists, arent really making a direct profit. However, their presence helps to keep the network decentralized.)

What Is Mining?

Mining is the process by which transactions are checked to see that they follow certain rules of the network. Miners are encouraged to perform the necessary checks and verifications financially.

This is done with the fees that are collected from users paying to send their transactions, as well as a special reward of new currency that gets released with every new block added to the chain. This type of payment is called the block reward.

Let’s look at a breakdown of what a cryptocurrency mining unit is actually doing to secure the network and release new coins. The process is very much the same for all cryptocurrencies that require mining:

- First, the computer checks a list of waiting transactions against the blockchain. They are making sure that none of the coins have been spent twice and each account or wallet has enough balance to send the Bitcoin transaction being requested.

- Then, the computer bundles these verified transactions into a block.

- Once a set of transactions is formed into a block, the miner must solve a sort of puzzle to publish the block on the chain. This puzzle is to guess the “hash” of the block.

When the mining computer system finally guesses the correct combination of letters and numbers of the hash, it can publish the block at the end of the chain.

Since each block contains the hash of the previous block too, the chain cannot be tampered with. If someone was to try to alter the number of Bitcoin at a certain address, it would make every block in the chain (after the tamper) invalid.

Which Coins Should Be Mined?

The very first thing to do is to choose the best coin to mine. One of the easiest ways to check the profitability of each cryptocurrency is to use a mining profitability calculator. All you need to do is enter some details (like total hashing power (hash rate) of your mining rigs, the total power that your rigs consume, and the price of your electricity) and the calculator will show you which is most profitable. The calculator will then show you the profit you can expect to make per day, per week, per month, and per year.

Another way to decide the best coin to mine is to look at the project’s long-term potential. It might not be quite the most profitable coin to mine today, but your mining could be a way to gather many coins before the price increases with future adoption. A coin like Ethereum would be an example of a project with huge long-term potential that might not be the most profitable today.

The third way is to look into the new coins coming into the market. They are fairly unknown and can be mined easily as there are not a lot of miners interested in it. As it starts getting some traction and recognition in the community, people start turning their attention and rigs towards it making it more difficult to mine with every new rig that enters its network.

Bitcoin

Bitcoin is currently the number one ranked cryptocurrency in terms of its market capitalization. Unfortunately, this doesn’t mean it’s the best coin to mine in terms of profit. This is because there are so many ASIC mining on the network already. For a miner who isn’t willing to invest literally millions of dollars on hardware, it’s not going to be worth mining Bitcoin.

Ethereum

Ethereum is a project with huge long-term potential. There is talk of decentralized home sharing apps like AirBnb or the equivalent of Uber’s ride sharing platforms being created on the Ethereum network. If one of these applications proves as successful as their centralized equivalents, the value of Ether tokens would shoot up.

Monero

Since it’s one of the most successful privacy coins, there are all kinds of reasons why people would want to use it.

There are plenty of Monero users who currently buy and sell things for Monero on dark web market places. But there are also many examples where privacy-focused coins are useful that aren’t illegal.

There are even entire nations who are interested in Monero. Take North Korea, for example. The rogue state has been reportedly using Monero to evade economic sanctions put on them by the West.

One of the best things about mining Monero is that you can still mine it profitably using either CPUs or GPUs. This is because it uses a different hashing algorithm to Bitcoin and other cryptocurrencies, which is called CryptoNote.

It’s also very easy to setup a Monero mining operation. It can be done using the GUI version of the wallet software. This makes Monero one of the best coins to mine for absolute beginners.

Electroneum

Electroneum was based on Monero. This means that it’s just as simple to mine as Monero. Again, the wallet itself has a very easy to use “mine” function that will start generating Electroneum with a click of a button.

The decision by the Electroneum team to make their coin one of the easiest currencies to start mining was deliberate. The team behind it truly wants it to become the cryptocurrency of the unbanked.

By making it easy for mobile phone users to use the inbuilt mining software connected with the default Electroneum wallet, they are hoping it will evolve into the most decentralized cryptocurrency. This easy way to mine the currency should give all those mobile phone owners in emerging economies a chance to partake in the digital economy without needing traditional banking services.

Zcash

Zcash is another privacy-focused cryptocurrency. One of the things that makes it a popular choice amongst cryptocurrency miners is that it ASIC resistant. This means that it is still very profitable to mine Zcash using the much cheaper GPU chips, so that is a huge plus when choosing your best coin to mine, if you don’t want to spend a lot on GPU.

AEON

Aeon is the most CPU friendly because of Cryptonite-light PoW. This narrows the CPU vs GPU performance gap considerably: you get a 3x hash rate improvement on CPUs compared to only 2x for GPUs compared to regular (Monero style) Cryptonite PoW.

Feathercoin (FTC)

Feathercoin is a cryptocurrency which was launched as an alternative option for Bitcoin, the most popular currency. This currency came into existence in 2013 amid having a small trading volume. Feathercoin uses NeoScrypt and GPU’s can help to extract it.

Litecoin

Litecoin is a peer-to-peer Internet currency that enables instant, near-zero cost payments to anyone in the world. Litecoin features faster transaction confirmation times and improved storage efficiency than the leading math-based currency Bitcoin.

It uses the Scrypt hash function from Tenebrix, an early altcoin, instead of using Bitcoin’s SHA-256 function. Litecoin Pool, Antpool and LTC.top are some of the most popular LTC mining pools. You can store your LTC on the Litecoin Core client which can be downloaded.

Dogecoin

Dogecoin is another very popular cryptocurrency that can be mined using a PC. It uses a Scrypt hashing algorithm and plans on issuing 100 billion coins. To mine Dogecoin, you will firstly need to download the official desktop wallet from the Dogecoin website.

You can mine Dogecoin either only using your CPU or by increasing your mining power with an AMD/NVIDIA graphic card. The best software to use when mining Dogecoin using GPU’s is CGminer, CudaMiner, and GUIminer.

Vertcoin

Vertcoin is a relatively new altcoin that uses a Lyra2RE proof-of-work algorithm to verify transactions. Vertcoin was also designed to be ASIC resistant. This means that it’s designed to resist the development of specific hardware to use for your purposes by large cryptocurrency mining operations. Instead it uses a Vertcoin team issued one-click miner. The miner is a graphical user interface (GUI) miner that facilitates mining for both CPU and GPU users. It has two mining pools based on your computing power. If you have less than two graphics cards, then you should pick Network 2, if you have more you should pick Network 1. Vertcoin supports AMD and NVIDIA graphics cards.

There are much more coins that can be mined. Usually you can find these coins listed on websites like Coinwarz, Minergate or Whattomine. These websites compare various cryptocurrencies mining profitability to Bitcoin to determine if a cryptocurrency is more profitable to mine than Bitcoin. The cryptocurrency profitability information displayed is based on a statistical calculation using the hash rate values entered.

Is It Worth It to Mine Digital Currency?

There are a number of considerations to take into account before you can answer this question. It certainly can be, but you have to make the right decisions if you want to make money with home crypto mining. Here are some things to consider:

- Will you use your existing computer equipment, or will you be buying new equipment?

- Which coin will you mine? You can even decide on multiple coins you might mine, and this will affect your decisions regarding what hardware to use.

- Will you be CPU, GPU or ASIC?

- Will you solo mine, or will you join a mining pool?

- Do you even need a hardware, or are there other alternatives that are acceptable to you?

Mining cryptocurrency requires a large volume of electricity due to the computational intensiveness of the task. While electricity costs vary drastically across geographies, researchers at Bitcoinist assert that miners are most profitable when they locate their hardware in low-cost regions such as Venezuela or Eastern Europe, a task that can be difficult given the shortage of crypto farms in those regions.

Adding to the economic strain, the upfront cost of hardware is not cheap. Investing in top-end cryptocurrency miners can cost as much as $5000 and take numerous months to break even, dependent on the amount of hash power on the network, prevailing market prices, and electricity costs, which may not be within everyone’s budget.

Lastly, cryptocurrency miners face diseconomies of scale. As additional miners begin to mine a specific cryptocurrency and the finite quantity of remaining blocks decreases, the expected payout per volume of mining hash power expended decreases. Moreover, as increasing demand for electricity caused by increased uptake of mining and societal energy consumption fuel upward pressure on electricity costs, profit margins of miners are at risk of decreasing further over time.

However, beginners could still make a fortune from mining certain altcoins. Scrypt-based altcoins are the best options for novices who are not keen on investing huge sums into costly mining rigs. These ones are memory-based and can therefore be mined using any GPU, which is a PC with high graphical capacity.

Cryptocurrency Mining Types: CPU, GPU, Cloud, ASIC etc.

Even though mining is a lucrative business opportunity, it is no casual undertaking. Early adopters had a relatively easy time since they could mine using their PCs and make a good profit from it. But for the most part, mining major cryptocurrencies today requires advanced hardware to generate a reasonable income.

Unless you have a very high end system, you won’t have much success in mining. At the very least you’ll need to add additional GPU’s to your system specifically for mining. This is going to mean you’re incurring additional costs, and will extend the amount of time you need to mine before you break even.

If you’re thinking of buying additional equipment, you’ll probably want to dig a little deeper before you decide what equipment to buy.

As you may have heard, there are 2 types of mining: traditional (hardware) and cloud mining.

Hardware

Hardware mining means that you will need to buy your own equipment and supervise all the necessary operating costs, liabilities, and setup fees. Mining itself consumes much energy. Moreover, hardware is very noisy depending on hardware type and brand. Therefore, hardware miners often join in groups to use various equipment to mine crypto currencies efficiently. Hardware mining is much more exciting, but a more expensive process.

ASIC

ASIC stands for Application-Specific Integrated Circuit. It is a microchip that is designed to execute hashing algorithm as fast as possible and ASIC is built for a custom single hash algorithm. It has an ability to calculate 100,000 times faster hash then best CPU. Currently, ASIC is designed by Bitmain and Canaan company. Cryptocurrency coin likes Bitcoin and Litecoin are based on ASIC mining.

| Advantages | Disadvantages |

| Low power use. | Cost can be very high. |

| A Very high hash rate for specific coin. | Application-Specific, for example, Litecoin ASIC can only mine Litecoin. |

| Physical size (much smaller and lighter for similar performance). | Low resale value. |

| High-profit margin. | Low resale value. |

| Non-upgradeable. |

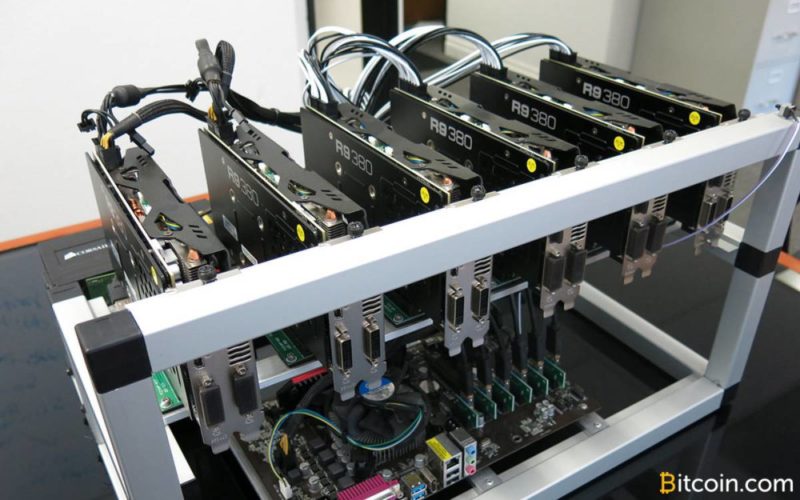

GPU

GPU stands for Graphics Processing Unit. It also known as video cards. It is not as powerful as ASIC, but it is more flexible in their application. The GPUs are often used in gaming computers for smooth flow of 3D animation and video. GPU can mine much faster than CPU. In order to mine Bitcoin, you must have at least one GPU installed on your computer. Nvidia and AMD are designed for better graphics.

Nvidia GPUs can be used as long as you have the drivers for your video card installed and AMD GPUs as they offer the best hashing performance for the money when we talk about hashing power, the cost of the GPU, and electricity is lesser. GPU has the ability to mine different coins such as Ethereum, Bitcoin Gold, Electroneum, and many others.

| Advantages | Disadvantages |

| GPU is very good at complex computation. | High power draw. |

| Easily sourced. | Not as powerful as ASICs. |

| Standard hardware. | Less Overall Efficiency compared to ASICs. |

| High resale value. | Requires large equipment. |

| Upgradeable. | Cannot mine certain coin. |

CPU

At the point when Bitcoin was begun, the only way to mine was utilizing Central Processing Unit (CPU) on PC and Bitcoin core wallet. Intel and AMD were the famous names in CPUs when bitcoin was released. One could dig only 100 coins a day using CPU. But it is impossible to mine bitcoin using CPU because of ASIC nowadays.

CPU was designed to switch between different tasks. Hash required proof of work in mathematical calculation and CPU has less arithmetic logical units. So, when it comes to performance in the large calculation CPU is relatively slow. CPU has the ability to mine different coins such as Zcash, Nexus, Hold coin, Reicoin.

| Advantages | Disadvantages |

| No specialized hardware required. | Electricity cost. |

| A Very good starting point to enter mining. | No longer profitable. |

| Invaluable educational experience. | Constant wear and tear on your CPU. |

| It is fun to mine. |

In the world of cryptocurrency, most of the coins are still based on proof of work. ASIC, GPU, and CPU also need to be considered as an important part of it. ASIC is the fastest as compared to GPU and CPU. ASIC is the most efficient way to mine bitcoin hardware. If you have large equipment budget and sticking to one coin for a long time, then ASIC is the best option for you but due to its cost and high maintenance GPU is taking place over it. So, if you want flexibility from singular coin then GPU is the way to go.

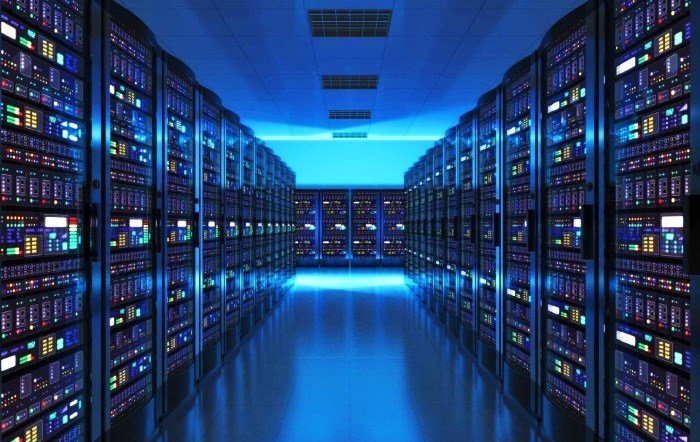

Cloud Mining

Cloud mining means that a cloud company purchases special hardware. Then it stores it at their place. After it, you pay the company for using this equipment to mine digital currencies. In this case, your payment mostly includes maintenance and electricity fees which differ depending on the country where the company operates.

In other words, an organization sets up mining rigs and maintains the facility. You just need to register and purchase contracts from the organization by depositing some fees. Once your fee is deposited and your contract initiates, the company will allocate its hardware to your account and all the rewards generated by that mining rig would be transferred to your account. The cloud mining company will obviously deduct some fees before transferring your rewards to your account.

CCG Mining will provide you with a variety of contracts. They can also build you a custom rig if ownership is really what you are looking for. This is a cool step in the next direction of owning your own rig, but not having to build it yourself. A great way to get started in crypto as a beginner.

Genesis Mining is the de facto industry. The only drawback to Genesis is that they dont always have contracts to offer so when they DO offer, don’t miss it.

NiceHash have created a marketplace for not only buying cloud hashing power, but selling it too! This means that if you want to sell some of your unused computing power you can on their marketplace and get a small return for it.

Honeyminer is a fairly new mining program, but really simple to use! It is easy to install and turn on. Great option for a beginner who is just getting into the crypto space.

MinerGate offers more coins to mine than Genesis does and they also allow you to mine different coins simultaneously without a decrease of hash rate. Similar to Genesis their contracts are not all always available.

How to Start Crypto Mining?

How to get into cryptocurrency mining? It’s not as difficult as may seem. Just follow these steps, they are basically the same for any coin that you would select. But in my example I’ll describe the Ethereum (ETH) mining.

There are three ways you can mine it:

- Pool mining (Recommended)

It is the easiest and fastest way to get started. You work together with other people. All of the people that are mining within a single pool agree that if one of them find the secret number, they’ll share rewards with everyone. How often you find blocks and share rewards depends on the pool size. However, not all pools are the same.

Every pool has a fee associated with it. You have to pay a small amount so that you could continue using the pool. This amount gets paid automatically, so you don’t need to worry about it. The payments are % based and are calculated in the cryptocurrency you’re mining. The amount you have to pay usually differs from 1% to 3%. You should look for a pool with around 1% fee as these are far more reliable than 0% fee pools. Running a mining pool is a full-time job and computing and data center space isn’t cheap. 0% fee pools are usually supported by donations, they might be less stable than pools with a fee to cover the costs. If the pool fee is higher than 3%, you should consider looking for another pool.

- Mining alone (Not recommended)

Mining alone might seem like a great idea. You don’t have to share any rewards. You just turn your computer on and let the money roll in, right? Wrong. When you’re doing Ethereum mining alone, you are competing with other people and will only get rewards if you solve the math puzzle first. Since you’re competing with a very large network of people and companies that have a lot of resources, you would need to get very lucky very often. Mining alone is only profitable if you have a lot of resources at your disposal, we’re talking 100+ graphics cards.

- Using Cloud mining services (Not Recommended)

When you are using cloud services, you are paying someone else to mine for you. The way this works is that you’re renting mining time from other people and in return, they give you all the rewards they can mine. It is a safe way for providers to guarantee themselves profit for the equipment they’ve purchased. Cryptocurrency price doesn’t affect them because you pay them in advance. So, when you buy cloud contracts, you don’t have to deal with any troubles that come with making your Ethereum mining rig. In an ideal situation, cloud is less profitable than mining yourself. Instead of using cloud services you can also just buy Ethereum.

As for me, pool is the best option, so here is the step-by-step guide:

- Create a digital wallet.

- Install your graphics card drivers. (The mining process will be more profitable if your hardware is running all of the latest updates. So update your drivers now.)

- Join the desired pool by install the right software. The easiest and quickest way to get involved is NiceHash. Simply visit the site and download the AMD or nVidia installerdepending on what video card you have (Note: some antivirus software picks up mining software as malicious files).

Cryptocurrency Mining Equipment List

As it was mentioned in the beginning, every cryptocoin may require different set of hardware and software. This is a list of things that you will need in case you decide to mine Litecoins, Dogecoins, and/or Feathercoins:

- A free private database called a coin wallet a password-protected container that stores your earnings and keeps a network-wide ledger of transactions.

- A free mining software package, like this one from AMD.

- A membership in an online mining pool.

- Membership at an online currency exchange, where you can exchange your virtual coins for conventional cash, and vice versa.

- A reliable full-time internet connection, ideally 2 megabits per second or faster speed.

- A hardware setup location in your basement or other cool and air-conditioned space.

- A desktop or custom-built computer designed for mining. Yes, you may use your current computer to start, but you wont be able to use the computer while the miner is running. A separate dedicated computer is ideal. Tip: Do not use a laptop, gaming console or handheld device to mine. These devices just are not effective enough to generate income.

- GPU or ASIC.

- A house fan to blow cool air across your computer. Mining generates substantial heat, and cooling the hardware is critical for your success.

How to Choose a Mining Pool?

Choosing the right pool is crucial for the efficiency of a mining operation. When you make this decision you need to think about the main aspects:

- Pool size

There is almost no difference between a small pool and a big one as eventually you will get the same amount of coins out of both. Small pools can hit an unlucky time period followed by an extremely lucky one, while the big ones have a constant flow of finding blocks. If you choose big enough time period to compare such two pools, you will see that you get the same amount of coins from both of them. That is also a fact, but with one difference – time!

The smaller the pool the greater is the time you will need to get the same amount of tokens compared to the big pool.

On the other hand, having over 51% of the Global Hash Rate in one single pool, can be dangerous for the Coin as this gives the means to the pool to manipulate the decentralized ledger and may potentially lead to the 51% Hash Attack.

- Pool functionality

Some people prefer a smaller pool that that gives you better tracking of your hash rates and earnings, while others prefer pools that give Block Finders Rewards, or pools that are built to prevent frequent currency jumpers that arrive for few fast blocks and then jump to the next more profitable coin. The choice is yours to make depending what you value in a pool.

- Pool trustworthiness

Before disregarding a pool because someone lashed and bashed against it on some forum, just check how many miners it has in total. If the pool has 200 miners on it, the probability if it scamming them is slim.

- Pool Stability and Robustness

Another important factor to consider before joining a pool is the assessment for its security. Does the pool offer a secure connection or an open connection? Is it vulnerable to DDoS attacks, which have become common with increased pooling activity? And if hit by hackers, can the mining pool withstand and repeal the attack?

- Payout Threshold and Frequency

If you have low-end hardware devices, you should avoid pools that have higher thresholds for making payments. Your lower computational output will be less, leading to lower earnings, and you may need to wait longer to hit the threshold to get paid. The same applies to payment frequency of the pool.

- Pool Fee Structure

Along with pools that charge a nominal fee to participants for using the pool services, there are pools that charge no fee at all. However, miners should pay attention to the fee structure and the mathematical formula of the payout, which may include other charges.

Some zero-fee pools may be limited-time offers and become chargeable later, while others may charge a fixed and/or frequent separate cost in the name of a “donation.” Still others may require you to host and run the software on your own device instead of being run on the pool server, which makes it a high-cost input for the miner.

Cost of Mining

The cost will vary depending on your geography and the coin that you would select. In general, you need to take into account the following factors:

- Electricity cost

How many dollars are you paying per kilowatt? You’ll need to find out your electricity rate in order to calculate profitability. This can usually be found on your monthly electricity bill. The reason this is important is that miners consume electricity, whether for powering up the miner or for cooling it down (these machines can get really hot).

- Power consumption

Each miner consumes a different amount of energy. You’ll need to find out the exact power consumption of your miner before calculating profitability. This can be found easily with a quick search online. Power consumption is measured in watts.

- Pool fees

If you’re mining through a pool (you should), then the pool will take a certain percentage of your earnings for rendering their service. Generally, this would be somewhere around 2%.

- Price of the coin

Since no one knows what the price will be in the future, it’s hard to predict whether the selected coin mining will be profitable.

Best Way to Mine Cryptocurrency

The best way to start in case you have free (or almost free) electricity and ready to invest in hardware with high Hash Rate and want to join some pool.

As you already know, different crypto coins use different algorithms while ‘mining’. This means that some cryptocurrencies work best with ASICs (Bitcoin), others better with GPUs (Ethereum), and yet others mine most effectively with CPU. So, depending on the algorithm the cryptocoin is based on, the answer to this question varies.

Conclusions

As you can see, there are lots of different things to think about when mining altcoins. There’s immediate profitability, long-term success of a project, and even whether you want to mine a currency for some reason other than profits.

Is it worth doing? Well, it depends on your expectations. Crypto coin mining can generate a small extra income. In particular, the altcoins mentioned above are very accessible for regular people to mine, and a person can recoup $1000 in hardware costs in about 18-24 months.

If you are looking for a full-time income, it is not the most reliable way to make substantial money for most people. The profit will become significant only if you are willing to invest $3000-$5000 in up-front hardware costs, at which time you could potentially earn $50 per day or more.