Bitcoin, aka cryptocurrency or digital gold, was created 10 years ago by Satoshi Nakamoto, a mysterious individual or group of people whose true identity is still unknown. The main idea behind the establishment of this virtual currency was to enable quick and cheap online payments without the need to use traditional banking channels. BTC, in case you hadnt noticed, is quite a big deal these days. A lot of people are talking about it, and theres a lot of noise in the media about it.

Do you own any Bitcoin? Do you know anyone who does? Worldwide, how many people own Bitcoin?

How Many People Use Bitcoin?

Are you interested how many people actually use Bitcoin for money? The answer to this question tells us what proportion of the population have bought into the idea, and therefore what proportion are left who might come on board in the future. And that, of course, gives some kind of indication about what we can expect in terms of appreciation in value, levels of future use, business prospects, and so on.

It turns out that theres plenty of speculation about this, too. Lots of suggestions, some of which are based on reasonable assumptions and mathematical modelling, and some which are just plucked from the air. This graph shows the number of unique addresses used at a given time which you might think was a fair proxy. But some forums come up with a range of answers from just a few thousand to a few million demonstrates some of the problems in guesstimating the real total, even with that information.

But don’t forget that crypto transactions are based on complete transparency. Every transaction that has ever occurred is stored in the blockchain. It also means that all the information you need is there for the taking, if you know how to access and interpret it.

According to a Cambridge University study, there are from 2.9 to 5.8 million active bitcoin users. The study was done in 2017 and gathered survey data from nearly 150 cryptocurrency companies and individuals, and it covers 38 countries from five world regions. At least 1,876 people are working full- time in the cryptocurrency industry, and the actual total figure is likely well above two thousand when large mining organizations and other organizations that did not provide headcount figures are added. Hence, we can expect the number of active users to be even higher in 2019.

Why people don’t Use Bitcoin?

Why is digital gold not a common way for people to buy things online? Well, there are several reasons for that.

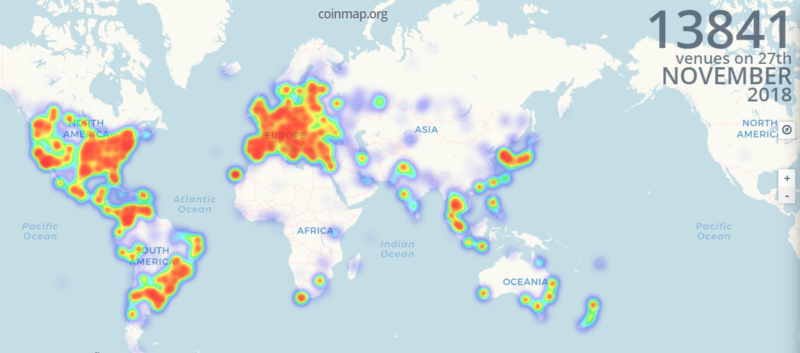

- Limited number of bitcoin-accepting locations

Even if you live in a big city like Toronto, Paris or London, you may still have difficulties finding a place that will accept crypto as a payment. Coinmap is a service that will help you locate the right spots all over the world. But we suggest calling businesses listed to make sure they really accept digital coins.

- Transaction speed

If your BTC transaction worth just a few dollars, it may take a few days of waiting to be confirmed. The likely reason is that the fee attached to the transaction in order to incentivize faster confirmation— is really small (e.g. 50 cents). What this means if you want to pay $3 for a coffee with a digital coin, you might have to pay an extra $3 or more just to get your transaction confirmed in a timely manner. The restaurant (or bar, or shop) could let you go before the transaction is confirmed, but then they take on the risk of selling their goods.

- New Technology

Its a very new technology, one that experiences volatility, and a lack of informative resources. Crypto is very convenient for online purchases, unless users are spending it on goods and devices, or all merchants accept it, its tough to use for daily purchases.

- Chargeback

Credit cards have it, so if youre defrauded or the supplier simply didnt come through, you get an automatic refund. While with crypto coins all transactions are irrevocable.

- Volatility

The value of digital assets is extremely unpredictable relatively to the dollar. The value of credit card debt is fixed in dollars.

- Owning cryptocurrency

Most people dont have any BTC, and getting them is a time consuming hassle. While most people have a credit card and know how to use it.

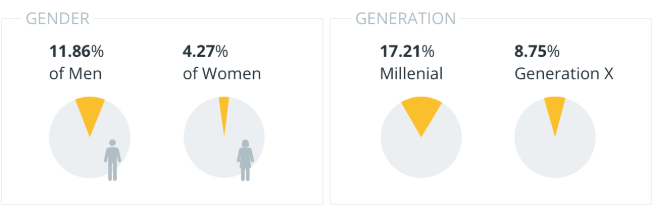

Who are the owners of Bitcoin?

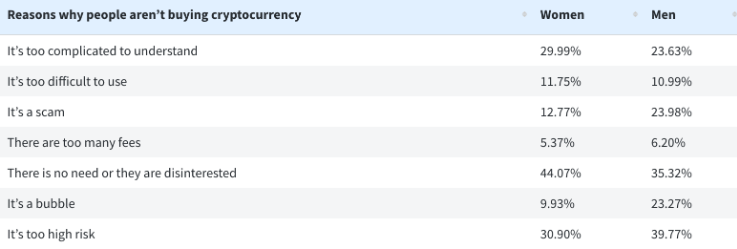

Who is a typical modern person who uses digital coins nowadays? Is it a male or a female? Millennials or generation X? Let’s look at the results of the survey.

Combining the data from Finder, LendEDU, and Global Blockchain Business and Survey Monkey, the following conclusions were made:

- Men generally invest in cryptocurrency more than their female counterparts.

- Millennials invest more compared to members of generation X.

- Those who are considering investing in cryptocurrency outnumber have made an investment in the digital currency.

Richest Bitcoin Addresses

The top 5 wealthiest Bitcoin addresses belong to cryptocurrency exchanges. All of them hold a total of 592,943 BTC, which is currently worth around $3,150 billion. This accounts for roughly around 3.5 percent of the entire amount of BTC.

- Binance

Binance is the world’s largest cryptocurrency exchange by means of traded volumes and its cold wallet currently holds 141,096 BTC worth $749,654,668. This is 0.8117 percent of all BTC and it’s the richest address so far.

- Bitfinex

The cold wallet of Bitfinex is the second richest BTC address. It currently holds 138,661 BTC which are worth $736,714,464 or 0.7977 percent of all BTC.

- Huobi

The third place is occupied by Singapore-based cryptocurrency exchange Huobi. It has 108,135 BTC in its wallet which are currently worth $574,526,670. This is 0.622 percent of all BTC.

- Bittrex

Bittrex’s cold wallet is the fourth richest BTC address and it holds 107,203 BTC. This is worth $569,577,142 or 0.6167 percent of all BTC.

- Bitstamp

Bitstamp holds 97,848 BTC in its cold wallet, making it the fifth wealthiest BTC address. Their dollar worth is $519,974,509. It accounts for 0.5629 percent of all BTC.

There are also individuals who are loaded with the crypto coins. Cameron and Tyler Winklevoss have one the richest wallet address.

It’s also worth noting that the overall BTC ownership of BTC has changed through the years. At some point, the US Government was in possession of more than 144,000 BTC seized in the popular Silk Road case.

Satoshi Nakamoto, Bitcoin’s pseudonymous founder, is estimated to own roughly 980,000 BTC. Satoshi made his Bitcoin fortune by being the first ever miner of the cryptocurrency and continuing to mine it throughout the early days of the blockchain. Despite this, Satoshi is absent from the richest list of Bitcoin addresses. Instead, his wealth is thought to be spread across thousands of different addresses.

Read Also: Who owns the most Bitcoin?

How many Americans own Bitcoin?

A survey conducted by the Global Blockchain Council and SurveyMonkey that was taken by 5,000 Americans found that 60 percent of Americans have heard of bitcoin and that around five percent hold the digital currency. If you would extrapolate that to the entire U.S. population, that would mean that an estimated 16 million Americans have invested in bitcoin.

Another survey conducted by Finder discovered that 92 percent of the American population has not purchased cryptocurrency and only eight percent of them plan on investing in cryptocurrency in the future. However, research indicates that Finder’s survey is not the most accurate representation of cryptocurrency demographics in the US.

It is difficult to estimate a minimum and maximum number of cryptocurrency holders via a survey. Even if we had data that told us the total amount of cryptocurrency wallet addresses in the US, so many people have forgotten their private keys, lost or broken the piece of hardware that stored their funds, have signed up for a wallet but have never deposited funds or have multiple wallet addresses.

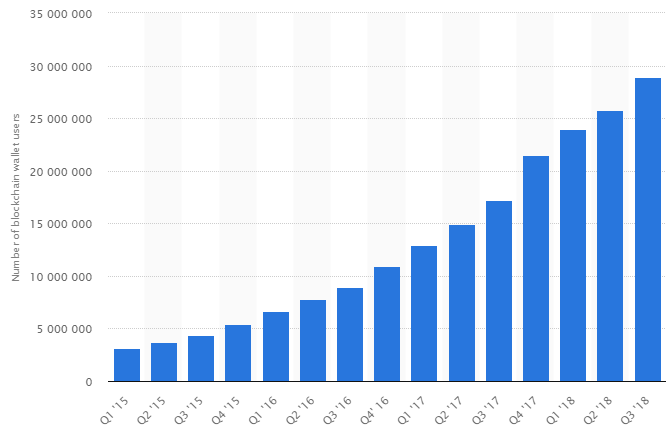

Number of Bitcoin Users Worldwide

The statistic presents the total number of Blockchain wallet users worldwide, from the first quarter of 2015 to third quarter of 2018. The number of Blockchain wallets has been growing since the creation of the Bitcoin virtual currency in 2009, reaching over 28 million Blockchain wallet users at the end of September 2018.

Bitcoin Vs. Other Payment Methods

Cryptocurrency payment companies generally act as gateways between cryptocurrency users and the broader economy, bridging national currencies and cryptocurrencies. They can fit into two broad categories: firms that use cryptocurrency primarily as a “payment rail” for fast and efficient cross-border transactions, and firms that facilitate the use of cryptocurrency for both users and merchants. The study found that the size of the average business-to-business cryptocurrency payment ($1,878) dwarfs peer-to-peer and consumer-to-business cryptocurrency payments.

Bitcoin Transactions vs. Credit Card Transactions

Credit card transactions entail the buyer effectively authorizing the seller to pull a payment from their account, passing through several financial intermediaries in the process. For example, a typical Visa transaction involves four parties: the merchant, the acquirer (the financial institution that enables payments to the merchant), the issuer (the card holders bank), and the individual cardholder.

When making a bitcoin transaction, it is not necessary to provide personal identification information such as your name and address. BTC transactions are made using an anonymous alphanumeric address that changes with every transaction and a private key. Payments can also be made on mobile devices by using quick response (QR) codes.

While credits cards are stored physically in a wallet, bitcoin transactions are sent to and from electronic wallets, which can be stored on your computer, smartphone, or in the cloud.

Digital transactions are irreversible and can only be refunded by the receiving party – a key difference from credit card transactions that can be canceled.

Bitcoin vs. PayPal

Bitcoin

Very simply, transferring money through bitcoin involves:

- Using your local currency to purchase bitcoin, then

- Selling your bitcoin for the international currency you want.

Your recipient receives your crypto transfer in a bitcoin wallet. They need to sell the BTC for their local currency. Finally, they need to withdraw the currency to their bank account.

Because bitcoin isn’t distributed by one provider, exchange rates will vary depending on which service you use. You might find exchange rates of a fraction of percent to a few percentage points above the mid-market rate.

PayPal

Here’s how to transfer money through PayPal:

- Fund your transfer with your PayPal balance, bank account, credit or debit card, or PayPal Credit, then

- Send money to your recipient’s PayPal account.

After your recipient receives the money, they can either keep the funds in their PayPal account or withdraw the money to their bank account.

To calculate the exchange rate it offers to customers, PayPal takes the wholesale rate it gets from its bank and adds a 2.5% margin. PayPal updates this rate twice a day.

While active bitcoin users are estimated at 5.8 million, PayPal boasts 235 million active users, MasterCard has 35.7 million American users and another 604 million active international users, and Visa accounts for a whopping 336 million American users and another 736 million users globally.

Summing up

Bitcoin popularity is expanding around the globe, meaning that this digital currency is likely here to stay. Crypto currency is still in its early stage and there is so much to happen in the future.