Although exact figures are hard to come by, many believe that fewer than 1% of all people, worldwide, are involved with cryptocurrencies. Sadly, many cryptocurrency community members have overestimated the industry by unbelievably large margins, expecting a high bitcoin adoption rate. It could easily take years for cryptocurrencies and blockchain technology to reach levels of adoption that are on par with other revolutionary technologies. Lets take a look at some facts and statistics regarding the adoption rate of Bitcoin.

Bitcoin Adoption by Country

Bitcoin market penetration is an important part of the development of the cryptocurrency industry. There are a lot of blockchain-related projects that have aims to provide Bitcoin and cryptocurrency education and popularize their use. The mass adoption of the digital coin is in its early stages and is not being performed widely, yet. Its use is not well-established and is hard to perform for a regular person to become interested in it. There were numerous attempts to quantify the adoption rate of Bitcoin, but they were extremely complicated due to the crypto privacy and lack of information about individual accounts. The mass adoption of crypto assets is growing because of the increasing use of cryptocurrency in businesses. The rising amount of enterprises, individuals and manufacturers that accept digital gold as a means of payment positively affects its adoption by ordinary customers and households.

After analysis of the 46 country datasets for LocalBitcoins, it appears that Bitcoin trading on the platform is extremely concentrated. 72% of all crypto trading happened in the top 5 countries: USA, Russia, UK, Venezuela, and China. The top ten accounted for over 86.5% of all trades done on the platform. This seems to indicate uneven adoption rates across the globe.

Most governments are still deciding on how to approach Bitcoin and have yet to pass decisive legislation. The usual approach is to classify it under some pre-existing category so that standing laws can be it applied to it, usually for taxation purposes. Certain nations are however making a concerted effort to embrace Bitcoin, as they realize that it could be of tremendous benefit to their economic future. By encouraging Bitcoin adoption and attracting companies, these nations seek to place themselves at the forefront of financial innovation.

Top Bitcoin-Friendly Nations

- Malta

It is a small country in southern Europe which has been a gambling paradise and a very welcoming country for the gambling businesses. In 2018, they have formed the Malta Digital Innovation Authority which is encouraging cryptocurrency and blockchain businesses to come to Malta has set-up their businesses.

Binance, the largest crypto exchange by volume, has recently announced that it will relocate its headquarters to Malta.

- Bermuda

Bermuda is a small Caribbean island, a former British colony that remains a part of the Commonwealth. A lot of financial companies operate from Bermuda, especially in the insurance sector, and there are 4 major banks situated there. Bermuda reportedly has the highest GDP per capita in the world, as its favorable tax rates and island lifestyle attract high net worth individuals and major corporations.

Bermuda’s light taxation policies extend to Bitcoin and cryptocurrencies in general. It is not recognized as legal tender in Bermuda, which explains its tax-free status.

- Switzerland

Switzerland is heaven for cryptocurrency enthusiasts. Moreover, it is home to some of the best cryptocurrency and blockchain companies in the world such as ShapeShift and Xapo. This has earned it the title of CryptoValley, something similar to Silicon Valley in the US.

The Bitcoin trading is allowed and if you are trader here you need to pay the capital gains taxes. If you are not, you are just liable to pay income taxes if you receive your salary in crypto.

The Swiss state railway company even accepts the coin for ticket payments nationwide.

- Georgia

Georgia the country (not to be confused with the US state) is an Eastern European nation of close to 4 million people. For purposes of attracting foreign investment into its IT industry, Georgia set up the Poti free industrial zone near its capital, Tblisi, in 2015.

In 2017, Georgia was ranked 14th in the world for ease of doing business and 13th for economic freedom.

Goergia has the 2nd highest Bitcoin mining hashrate in the world after China, according to the Global Cryptocurrency Benchmarking Study, published in 2017.

Companies situated in the Poti free industrial zone benefit from a preferential taxation scheme. Within this zone, there is no VAT, dividend, profit or property tax. Tax on leases and salaries will still apply.

- Belarus

Belarus is an Eastern European nation of nearly 10 million people. The government has recently embraced cryptocurrency as part of its program to develop the IT sector and attract foreign businesses, investment and talent.

Under the Ordinance, Belarus has waived all taxes on cryptocurrency transactions and income for five years (so until January of 2023). In other words, no taxation of mining, trading, or other business activities involving crypto. Tax-free status applies also to business conducted with foreign countries.

Top Bitcoin-Friendly Cities

- San Francisco, U.S.

The city currently has 177 merchants accepting tokens and 29 BTC ATMs. San Francisco is home to startups such as Coinbase, developer of the world’s most popular bitcoin wallet.

- Vancouver, Canada.

Vancouver boasts 86 crypto-accepting merchants and an impressive 48 BTC ATMs. The city of 578,000 inaugurated the world’s first BTC ATM and is the headquarters of the Quadriga CX crypto exchange.

- Amsterdam, the Netherlands.

There are 74 bitcoin merchants accepting crypto coins and one BTC ATM. Nearby cities Utrecht and Hague are also friendly to cryptocurrency. Amsterdam is home to leading crypto startups including BitFury and BitPay.

- Ljubljana, Slovenia.

With a population of only 272,000, Ljubljana has 51 merchants accepting bitcoin and five ATMs. The prominent Bitstamp exchange is headquartered in Ljubljana.

- Tel Aviv, Israel.

Israels financial center and one of the worlds leading cities for startups has 58 merchants accepting BTC and four ATMs.

Bitcoin Adoption Rate Since 2010

Bitcoin exploded onto the global stage in 2017. News, investors, the tech community and even taxi drivers were talking about this digital coin with excitement. Seven months of the coin price sliding down have done a lot to dampen this enthusiasm. Let’s take a look at the by year chart to view how the most famous crypto was evolving:

| May, 2010 | The first, real-world transaction using digital gold takes place when a Jacksonville, Florida programmer, Laszlo Hanyecz, offers to pay 10,000 tokens for a pizza on the Bitcoin Forum. At the time, the exchange rate put the purchase price for the pizza |

| July, 2010 | Over a five day period beginning on July 12, the exchange value of BTC increases ten times from US$0.008/BTC to US$0.080/BTC |

| November, 2010 | The crypto economy exceeds US$1 million. The price on MtGox reached US$0.50/BTC. |

| January, 2011 | 5.25 million coins have been generated, totaling more than 25 percent of the projected total of almost 21 million. |

| February, 2011 | Crypto touches US$1.00/BTC at MtGox, reaches parity with the US dollar for the first time. |

| August,2011 | The first Bitcoin Conference and World Expo was held in New York City, NY. |

| March, 2013 | The total BTC market cap passes US$1 billion. |

| May, 2013 | The first Bitcoin ATM in the world is debuted in America (San Diego, California). |

| November, 2013 | Bitcoin transaction volume surpasses Western Union and space traveling becomes possible with crypto coins. |

| May, 2014 | Federal Election Commission approves BTC donations to political committees. |

| September, 2014 | PayPal starts accepting crypto payments for merchants. |

| December, 2014 | Microsoft announces that it will accept digital assets on its platform. |

| May, 2015 | First regulated bitcoin-based security began trading in Stockholm. |

| September, 2015 | BTC is a Commodity according to The Commodity Futures Trading Commission. |

| April, 2016 | You can buy games on Steam with cryptocurrency. |

| October, 2016 | Swiss railway ticket machines to sell digital currency. |

| April, 2017 | Japan passed a law to accept a digital coin as a legal payment method. |

| August, 2017 | Segwit activates on Bitcoin. |

Cryptocurrency Adoption vs. Internet Adoption

The Internet, despite its revolutionary capabilities, was expected to fail by many of its critics, as the Internet wasn’t widely adopted on its arrival. Looking back now, it is clear to see how mistaken these critics were. Some believe that users should take a similar perspective while looking at the cryptocurrency market, taking a longer-term optimistic approach while looking at the current state of the market. This belief is a direct contradiction with the short-term profits which speculators have focused on, nearly deifying 2017’s cryptocurrency bull run.

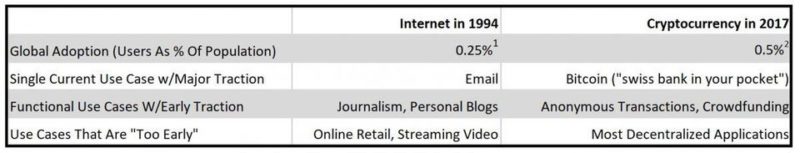

According to article by Ari Paul on Forbes, in terms of adoption of cryptocurrencies, we are at the same point in time as the Internet was in 1994. Sometimes it seems like everyone is talking about Bitcoin, yet less than 1% of the world owns any.

In 1994 there were too few internet users, too little trust in online credit card processing, and too little underlying infrastructure for online merchants to thrive. Another example of the problem of being “too early”: you can’t launch a high speed video streaming service if your potential customers are on dial-up modems.

Many cryptocurrency projects are struggling for similar reasons. There are too few users prepared to utilize cryptocurrency, there’s too little trust in cryptocurrency and blockchains from a security perspective, and there’s a lack of underlying infrastructure. Additionally, as with 1994, some of the eventual world changing use cases probably haven’t yet been thought up.

The technology has grown more stable and trustworthy, the user interfaces (GUIs, ATMs, bitcoin wallets for easier secure storage, etc.) make the tech accessible to non-engineers, and the network effects continue to grow along with the user base and market liquidity. But…global adoption remains trivial at less than 1%. The entire combined market value of all cryptocurrency is less than half of Facebook’s equity and 1/25th the market value of gold.

But there might be people who entered the world of cryptocurrencies after December 2016 and may have directly gone into Ethereum and from there onwards into ICOs and utility token.

And if we count the household investments done in joint accounts (whether this is couples or entire families) instead of one cryptocurrency user, we may get different numbers.

Can Bitcoin Become the World’s Single Currency?

Different countries have different opinions on Bitcoin and other cryptocurrencies.

Some say it is a threat to their national currency and stability, while some openly embrace the fundamentals.

Some countries embrace it as they fear they might lag behind in adoption while some want to adopt it but are worried as to what if Bitcoin becomes the world’s only currency.

This dilemma has divided the world into two categories: who likes and rejects it.

Bitcoin will overtake the dollar in importance as it becomes the single global currency of the internet within a decade, Jack Dorsey, one of Silicon Valley’s leading entrepreneurs, has said.

Despite recent weakness in the value of BTC and concerns that it cannot currently process transactions fast or cheaply enough to act as a currency, Mr Dorsey, who is chief executive of both Twitter and the payments company Square, believes that bitcoin will overcome these obstacles and will be used to buy everyday items such as coffee.

The crypto future looks promising from a technical standpoint, but is Bitcoin adoption actually as global as some media outlets would have us believe? The truth is that most cryptocurrency trading is done on crypto exchanges or in the over the counter (OTC) market. For those who don’t know, OTC markets match BTC buyers and sellers off public exchanges. This means that someone can buy tens of millions of dollars of BTC without moving the price. The problem with these ways of buying Bitcoin is that there is no public data on how much BTC is being bought and sold in each country.

However, Bitcoin country data is available for LocalBitcoins. In a nutshell, this site enables people in different countries to exchange their local currency for digital coins. This can be done either online or in person. It must be noted that the $6.3 billion traded on LocalBitcoins is a fraction of the global trade volume. However, there is more than enough data to get a reasonably accurate idea of the levels of BTC adoption in specific countries.

At this point, it is too early to answer this questions. But if it is possible? Sure!

Conclusions

The idiom “Rome wasn’t built in a day” is the perfect phrase to ascribe to the current state of the industry, as speculative investors cash-out their cryptocurrency investments en-masse. The maturation of the cryptocurrency market may take a while, but these developmental steps are important to make sure that cryptocurrencies are ready for mass adoption. And the current rate of the world first crypto coin may jump up high any time.